With concerns of inequality rising, environmental, social and governance (ESG) standards and principles have become a mainstream topic of interest. With organizations having to look beyond profits and focus more closely on the social context of their business, to appease investors and employees alike.

By following an integrated approach like ESG, a culture of long-term value creation is prioritized that helps the overall business. While ESG isn’t the responsibility of just one team, it’s a company-wide approach after all, it does have big implications for HR departments. Meaning business leaders are hungrier than ever to learn more about the impacts, challenges and solutions of ESG from the HR perspective.

During Nakisa Connect 2022 we brought together some of the leaders in the field to share their experiences and insights with us in a panel discussion moderated by Robert Nardi, COO at Nakisa:

- Shawn Husband, Senior Director of ESG Reporting at Walmart

- Suzanne Klatt, Director of ESG Strategy & Programs at IBM

- Nura Taef, Partner, ESG Reporting Advisory, Audit & Assurance at Deloitte

- Dr. Soodeh Farokhi, VP of Product at Nakisa

Robert Nardi: How is ESG impacting the long-term business strategy at your respective organizations?

Shawn Husband: ESG is really getting infused into our long-term goals broadly across the business. So, everything from refrigeration, to how do we replace units at end of life to get more efficient? Into the social and capital areas and our CDI (clinical documentation improvement) efforts. How we look at workforce composition, and how we're hiring and who our officers are, to fleets in our trucking fleet, how can we get more real use into the goals across the business today?

Suzanne Klatt: For ESG at IBM, it's really no longer considered a nice to have. It's becoming the social licence to operate I think for most corporations. So clients, current and potential employees and investors in society are really demanding higher standards of ESG. So, to address these issues, in December we created and launched a centralized ESG function to increase visibility across the company and to our public commitments, and how we're tracking and reporting on progress.

So, in April, mid-April this year, we publicly launched IBM impact, which is IBM's ESG strategy and framework. It is comprised of three pillars. Those are environmental impact, equitable impact and ethical impact. Within the framework, we have 10 commitments that guide our ESG strategy, including our net zero commitment and our commitment to skill 30 million people by 2030. And we're really looking to ensure trust, transparency and ethical leadership to reinforce our purpose as a company. And so, we really see this as a whole accompany approach. As a B2B company, we try to lead by example and create impactful solutions by helping to address ESG challenges of Global Fortune 500 companies and governments.

Robert Nardi: Nura from your perspective, you're constantly advising clients around this topic and you're one of those subject matter experts, so I’m interested in getting your perspective on the trends you're seeing with your clients and how it's impacting their long-term business strategy.

Nura Taef: I echo the comments by Shawn and Suzanne. I think we're really starting to see a paradigm shift today. Organizations are looking at value through a new lens. It's a lens that goes beyond just financial metrics. It's really embedding those principles of people, planet and prosperity into the core of a business and really the tenants of how a business operates. I think reporting is really one of those channels, those mechanisms through which this new strategy, this new lens, and perspective can be conveyed.

One of the challenges that I see is that organizations today, a lot of them do report on ESG or sustainability information. Over 90% of S&P 500 companies do have that reporting today. But that's not necessarily meeting the mark of all the stakeholder demand today. The demand is really on connectivity of ESG information with financial reporting and ensuring that intersection is well understood and it's well articulated.

So, a lot of the clients I work with are trying to find that balance of how do we start to bring this information into financial reporting, into financial filings. We're at a challenging point in time where mandated disclosures and financial filings on ESG information is not quite at its maturity. We're starting to see the introduction of these proposed rules by the SEC for example, in Canada the CSA, but they haven't quite materialized yet. Despite this lack of materialization, stakeholders still want that disclosure. They want to know that connection. So really bridging the gap in meeting the expectations today and starting to prepare for the significant increase in expectations going forward from a disclosure perspective is a big challenge and a lot of organizations are just trying to understand where to begin, how to meet the mark this year.

Robert Nardi: When aligning with the overall ESG strategy, what human capital metrics are relevant or the most relevant, and why?

Suzanne Klatt: So, HR metrics are developing and there are some agreements on these disclosures. However, the next challenge within the ESG framework is really the S measurements. We've really built out E. I think, more or less, that there's some work to do of course always, but the S measurement really needs to broaden. We really want to understand of those future metrics, which ones will be critical. We do have some metrics that we disclose, such as pay equity, number of women and executive roles. But this is the current picture. What we're looking to do is to develop the future, what will the future workforce look like?

I can give you an example for IBM. Companies are now focusing on skills and the future of work. A key challenge for HR is to create the future workforce aligned to future demands and hiring based on skills is part of that answer. So how are we going to approach that skills first concept? How are we going to measure it? This is one challenge that we really have in front of us.

So, IBM takes a 360 approach to this. For the talent pool, we are training the current and future workforce on the required skills and issuing credentials that are recognized by the market. Last year, we issued a commitment to train 30 million people by 2030 and we track this goal annually.

On the HR side, more than 50% of our job postings in the US now require a four-year degree, and we are tracking that as well. I don't know if anybody saw on Sunday, the former CEO and Chairman of IBM, Ginni Rometty, was on talking about exactly that with, we call it new collar jobs, and it was under her leadership that this program began.

Shawn Husband: With over 2.2 million associates across the globe, we believe that it's important for us to represent the community that we're in. When our customers come into a Walmart store or Best Price store, bodega store across in any one of our markets, we want them to see that the associates that are in the stores look like them, they're comfortable, they can identify with our business.

So, within that then, we're tracking and certainly what the percent of women in our total workforce, percent that are our management, percent that are our officers, the women of colour. Also, we're tracking the people that we’re hiring, is that improving those statistics and base? We also look at the age profile relative to society, and proportions of our leaders by ethnicity as well. Those are all publicly disclosed for us on our website and our reports.

Then more outside the CDI metrics, just pure human capital, we also disclose our average hourly wage and our average hourly total comp. Certainly in retail that is a very prominent disclosure that's well versed and politicized. What's the economic wages and are we providing enough pay for people to be able to support themselves.

We also track promoted associates and associates that are in education programs. Similar to what Suzanne uncovered, we have educational programs that are now free, where you can get college degrees as an associate in a Walmart store without paying anything. We used to require $1 a day. They got rid of that so that's now free. So, you can get higher education. That's one thing that we track.

We actually find that the people that are enrolled in those programs have a much higher percentage of promotions than any other associates. So that education really, really pays off for them. That's one that we definitely track and sponsor for associates.

Robert Nardi: If we look at it from an overall challenge perspective, what do you see as being the biggest challenges in your organization with regards to ESG?

Shawn Husband: It is a great question. Even those limited metrics I just brought up, that's just in, as Suzanne put it, in the S, I've got the E’s and the G’s out there too. So, if you throw all the metrics in there, and we are I think the term I use is a robust discloser of information. There are hundreds of pages on our website of ESG information. If you go through there and just track how many things we say we're trying to do in the world and how many metrics are in there, it's once again, I'm in the hundreds.

How do I get that all accurate, timely, reliable and consistent? It's a real challenge to do that in an efficient manner, and especially when you throw in the global aspect of that. Even if you're US based, I wouldn't say well that's easy, even our geographies across the US make that a challenge. But there's just simple things like even tracking the ethnicity and trying to say, well, who do we consider a minority? I have minorities in the United States that if I take those and go into our businesses in China or into Mexico, well, they're not minorities there. So how do you create a global number on some of these? So, we ended up disclosing different metrics where I have US ethnicity verse what I would report international markets. But then you get to things like the SEC who would want you to report on a consolidated basis on their timeline within your fiscal timeline. Well, how do I aggregate if I'm bringing in all these entities from across the globe?

So, most organizations even HR partners here would all understand we've gone through SOX a long time ago to get our financial processes to a point where we can have an efficient close and be able to get information out and have automation in there and put financial controls in there. Well, taking that and then turning that into an ESG process that feels SOX-like is a significant implementation again, and I find it much more complex and challenging than what SOX was.

For SOX, honestly, we've brought armies of consultants and implemented systems. So, I don't see this as different. I think you're going to use a significant level of resources, consultants and automation if you want to get your ESG landscape to look like your financial landscape and a lot of controlling automation. And I don't see that as an option going forward, personally.

Suzanne Klatt: Yeah, I can't agree more with everything that Shawn just said. But to summarize it, I think the four challenges that I really see are standardization of metrics and measurements, so it's a challenge to align industry standards for reporting. Industry by industry, they're very different for what a Walmart would report versus what an IBM would report. There are obviously some similarities, diversity inclusion is a really great example of that.

Then assessing and considering the qualitative and quantitative data. Shawn talked about SOX and so with ESG there's this added challenge of there's qualitative and quantitative data. It's not just the numbers. You have to explain and tell the story around the numbers. It's not a black and white reporting that we're looking at with ESG.

Then the general alignment across companies and industries on common goals. You need to make sure that we're aligning not just in the United States but globally, and not only for the company.

That leads me to my last challenge is we're reporting for multiple stakeholders, right? So, this is not just for the SEC, it's not just for the European Union, the CSRD. Our customers are looking at it. Our employees are looking at these numbers. Are you telling the same story internally versus externally? How do you capture that in a report or in a website or in your messaging each year? It's a really big challenge, mainly because we're talking about multiple internal and external stakeholders.

Robert Nardi: How can HR professionals improve their ESG focus value proposition in the context of a talent strategy?

Soodeh Farokhi: First, in my view, it's policy. So, the implementation of the right policies such as diversity and inclusion obviously can assist business in effectively tracking the progress. If something happens, there's policy for discrimination or harassment. If these policies are implemented correctly, then they can effectively ensure that employees also have right to raise any issue that happens to them at the workforce at the very earliest stage without escalation.

The second one, I would say again the touch point on it is training. It's important in particular for employees that are in a managerial role, because if they have enough knowledge and insight regarding how to spot issues related to discrimination or stress or anxiety, that could definitely affect the workforce. And effective training can equip managers with the right tools to again deal with issues at the earliest stage.

Another aspect can be gender pay and ethnicity reporting that although it's not mandatory as a legal document yet for companies to report on, we are seeing an increase in the businesses moving to voluntarily report on these areas in the interest of transparency. This can also be an initial step towards ESG reporting, especially on the social aspect of it.

The last one, in my view, is collecting the diversity data. This data for sure is important for the business. But the only way that you can track your progress and benchmark your progress is by having the data. So, if you start getting this data out, of course it comes with a lot of challenges. But then you can build upon that and track your strategy. I think these four are the main things that HR professionals can help on the ESG credentials.

Robert Nardi: How can HR professionals ensure that they've identified the correct data points for the social aspects of ESG metrics?

Nura Taef: I think to date, just to backtrack a little bit, a lot of organizations have worked in silos. Every function has their own remit and they've been operating under that remit. But ESG is so core to the business, it's so pervasive, it's so expansive, that it's going to impact every function. I think any organization needs to have a very unified and integrated approach to really be successful in telling that story on ESG and really ensuring it is embedded in the business. So that unified governance and infrastructure is really important.

I think to that effect, HR professionals really need to ensure that they have a seat at that table, they are representative, and they are participating in the decision making. And as part of that participation, they can also ensure to understand the purpose behind the data. I think it's very important to understand what the data is going to be used for, how it's going to be used as a communication tool, establish strategy, what metric it's going to ultimately lead to. I think having that understanding will ensure that you are pulling the right data, you are tracking the right data, you have the right processes behind the data to really ensure that you are able to confidently report this to the other stakeholders internally and externally as well.

Robert Nardi: A second question, Nura, for you, and this is mostly around the disclosure and reporting. What trends are you seeing from your clients, particular with regards to ESG and the disclosure and reporting aspects?

Nura Taef: I think one of the things I've been having a lot of conversations with my clients around is that this is really an evolution in corporate reporting. It's really a paradigm shift. It's reinvigorating the way we think about reporting, and not to view reporting on ESG as a disclosure and compliance exercise. This is not that. It is an opportunity for organizations to, as Suzanne mentioned earlier, really earn their social licence to operate. And reporting on ESG is really just the mechanism through which this transparency and this accountability can be materialized. It really enhances and inspires trust for organizations.

ESG is really quickly becoming the language of capital markets. So, my biggest advice when I talk to my clients is to ensure that there's authenticity in the way you're reporting to your various stakeholders. I think that authenticity is often demonstrated when you're telling a consistent story to your stakeholders. So, I often encourage my clients before you start thinking about checking the boxes and ensuring you're meeting the mark on various metrics and qualitative disclosures is, what's the story you want to tell your stakeholders? What's the story you want to tell capital markets? And is that story being told consistently?

As I said earlier, given the various functions and the operating in silos, there could already be a story being told to the market. So how do you ensure that everyone's operating in parallel and telling that consistent story and really integrating these principles into the way that that communication is occurring?

Robert Nardi: So, we've talked about the impacts, we've talked about the challenges. Maybe we can shift gears in terms of solutions, and I'll ask the same question to all the panellists. So, knowing the challenges, and specifically around HR, what solutions do you currently see to address both the impacts and challenges of ESG?

Shawn Husband: Yeah, it is a great question. Especially when you bring in the perspectives that Nura and Suzanne and others have added, is getting an alignment on what you're trying to report and what's out there and the breadth and depth of what we could disclose to the global nature, to the different diversity metrics that are out there. It's interesting because we would refer this, the system, the processes, like a singular concept. I think someone told me we have hundreds of human capital systems we use. I can't even believe that's actual, but they told me that with confidence!

There certainly seems to be… I can't imagine we're alone. I have to think that other companies out there don't have this wonderful, integrated, automated HR process that's turning out their metrics from one consolidated system. So, I think the environment seems to be right where HR applications seem to be in a space where I've implemented this for one thing, or that system for another, and this system for another, and so we have a spiderweb.

So certainly, one of the things we're doing in our initiative is to have some more consolidation in the information that I'm gathering. I have to bring that into a common place in which I can have controls and certifications and testing and reliance, and I have to be able to report out that.

You have to know what is it you want to say, what are your goals? Therefore, what am I tracking against that? You have to start from there. Otherwise, you're going to go create a different spiderweb instead of the right one. So, I have to get to what is it that I want to talk about, what's my story, what's my alignment? And then from there, what are the right metrics?

Okay, now I can go downstream and say, "What's the most efficient manner in which I can pull that information together and then go down the path of are there solutions out there that can help me get to an integrated, automated, efficient, compliant platform?

So, I definitely see the space as one that is ripe for the ability to put in solutions that can help you get to that, where you can turn out your metrics on a consolidated timely basis.

Suzanne Klatt: I agree with what Shawn said. I think regardless of the size of the company that you're working at, there's multiple systems when you're looking at HR just because it's such a broad category. But I would say ESG is about strategy, data management, reporting, and technology. And I think going forward, all of these will be crucial as we move forward and advance ESG reporting.

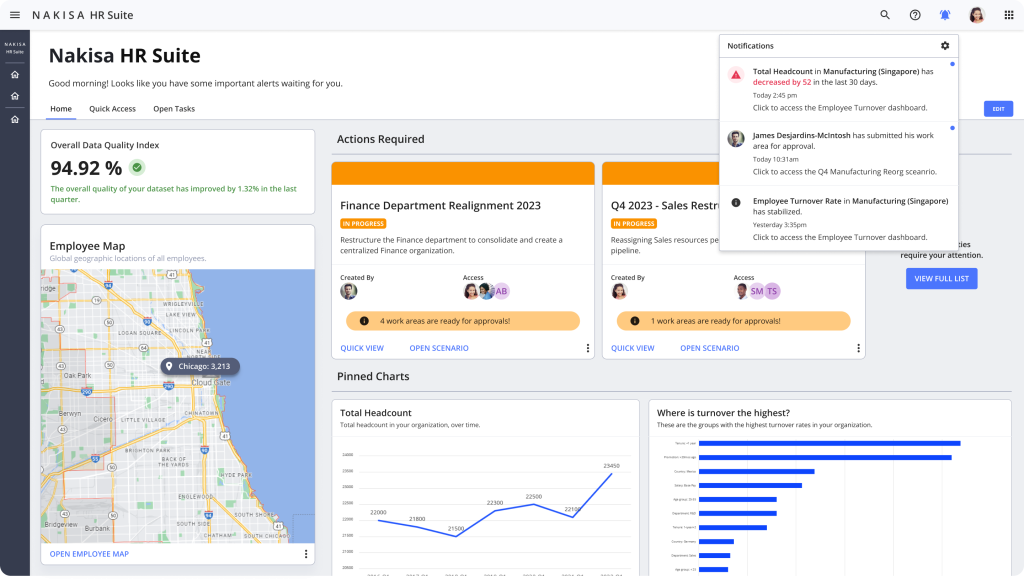

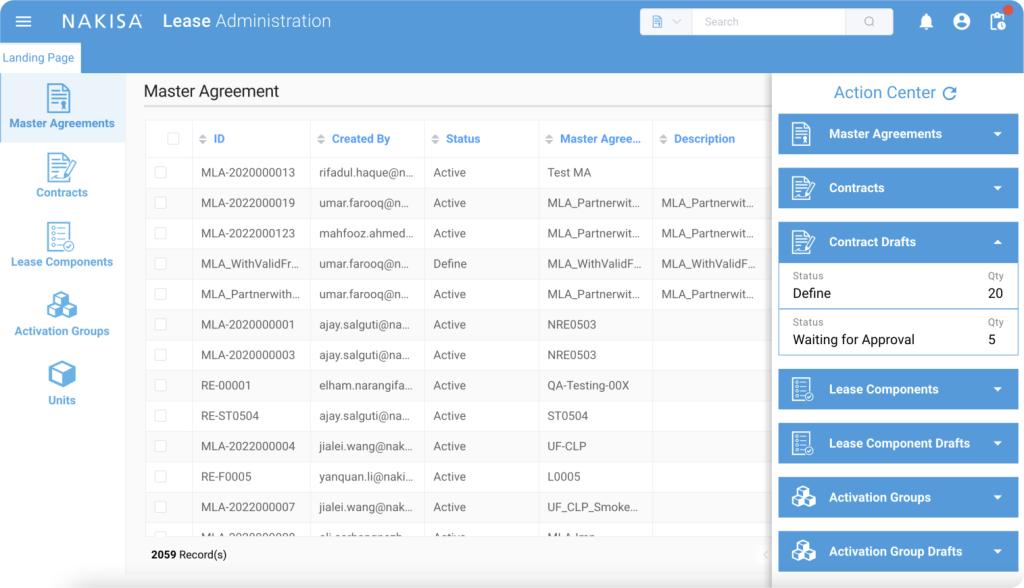

We need to pay attention to new technologies. So artificial intelligence, and technology in general, is the most transparent and efficient way to measure progress. And so, technology will help us make better decisions, predict outcomes, create solutions, and in the end build a better ESG strategy for the future. Not just for companies, but I think globally or the global community at large.Check out the AI-driven organizational design and analytics suite that drives your business forward

Robert Nardi: Nura, in terms of your perspective, advising several clients and looking at the storytelling, what are your thoughts around what are possible solutions? Or what are you seeing in your universe around solutions to address the impacts and challenges that we mentioned?

Nura Taef: Yeah, so interestingly enough, we recently did a survey of a number of US executives to get their thoughts on ESG reporting and some of the concerns they had. Over 90% of those executives had concerns over the availability and quality of the data. Really having the adequate technology to facilitate the disclosure requirements is just a very common concern I think amongst all organizations, all executives. So don't undermine the level of effort is really my recommendation here. And that's what I'm seeing is that, as you get into the details, you really unravel how much information is required, how pervasive it is, how it sits with different owners, how different owners have different processes. I think a lot of organizations today is we even take a step back and are tracking things manually. So, it's not even about the web of solutions and systems that exists today, but also what exists manually that can start to be automated.

So, I think gathering that universe is step one and ensuring you really understand where all the data sits, and then working with a consulting firm or a solution provider to understand the capabilities that exist. Because the more you can consolidate, the easier this is going to be in the long term. This is not going to go away. This is just going to get more and more complicated over time. The demands are going to get more significant. So, you want to try to get it right at the outset, while we have some time to really build the SOP and make sure the foundation is strong.

Robert Nardi: Soodeh, from your perspective, how do you see this from a solutions perspective? Obviously, you've got a technology background, but I'd be curious to get your thoughts on that.

Soodeh Farokhi: I echo all of the great points that they mentioned, but I'm going to look at it from our HR professional perspective. I think the first thing that we need to accept is that the focus has been on the environmental impact for a very long time. And after global pandemic, there is a shift that now the spotlight is on social aspects. So first of all, I think we need to as an organization and especially the HR professionals, we need to take this seriously that now the focus is on the social aspect. And of course, everybody mentioned that data is a big challenge.

Data is always a challenge I would say in any sector, but especially in ESG because the quality of the data, where to collect the data, the process of vetting the data to make sure that the data is accurate and the integrity of the data, all of those are big challenges especially again on the social side. Because there are a lot of unknown, a lot of non-deterministic paths and processes that are in place. They mentioned that there are a lot of manual process for gathering the data.

So first of all, I think for HR professionals, they need to embrace the challenge. They should be aware that data is going to be the first challenge that they need to embrace. Then they need to start putting in place processes, step-by-step, by prioritizing what are the key metrics that they want to go after first, and then have an approach like a data lake so that they can collect all the data. Then they can build up the data consolidation process, and then they start checking their frameworks that they want to follow. I think that's also important because it gives them a structure. Then based on that, they can start tracking that data. It can be first, maybe manually, but of course it comes with the solutions that again the data lake that they accept different types of data, they can have compliancy toolsets that helps them on the integrity of the data.

Robert Nardi: What are the critical aspects of ESG reporting for an enterprise that's in the initial stages of implementation?

Suzanne Klatt: I would just say to get started, don't let perfection be the enemy of the good. And so, you have to start somewhere. I think the first step out of the gate is the most challenging and look at all that low hanging fruit and so what's out there that you already have that you can report on as opposed to getting more complicated with it.

You really want to make sure that you have buy in from everybody. So, from grassroots to grass tops, make sure everybody's aware of what you're doing from the get-go that this is the plan and that you have a plan. It doesn't have to be very detailed, but make sure you have a three-to-five-year plan when it comes to reporting or when it comes to metrics and targets.

The first step is just to get out there with reporting. I think, in target setting from an HR perspective comes maybe at the two- or three-year mark when you have seen the data and you can make some assumptions and goals around the data.

I think some companies do it backwards where they set the goals. I've seen that with net zero, we're going net zero, well, how are you going to get there? And the company says, I don't know, we have 25 years to figure it out. I don't think that's a really efficient way to do things and I especially don't think it's an effective way to do things when you're talking about human resources and human capital management.

Shawn Husband: I do think we have some of those goals out there by the way that we don't know how to get to. Actually, I think some of those need technological advancement to get to. We have a zero goal, not even net zero. So, on emissions I can't do that with today's technology. But we will help invest in the world to get there.

I think one of the things that Nura brought up earlier, really is important when you talk about getting started, I think if you just pull information together and turn some reports out, I think you can create a problem. I think you really do need to step back and get that alignment with your leadership on what is our story, what are we committed to? As Suzanne said, what are those goals? As much as I joke about our climate goals that the technology just isn't there yet, but we know it's important, you do need to have a balance there. It can't just be goals are thrown out there that just will never be achievable. You have to have some stretch, but you also have to have some realism.

So, you have to align on that message, that strategy, those goals first. That way the effort you're putting into it, particularly when you're starting out, are aligned towards what your message will end up being. Because I'm sure I'm not the only one, it feels like once you create a metric and disclose it, it's hard to get out of disclosing that metric, and it feels like we only add requirements. The SEC or the regulators or TCFD, SASB whoever it is, it doesn't feel like every time they issue something new, they're taking something away. So, it feels like the universe grows.

I think it's important to have that thought process then if I'm going to turn up reports, what is it that my stakeholders want? And that's a broad concept. It's everything from the community, to regulators, to investors, to analysts, to customers, to associates, what are my stakeholders driven, motivated to see me talk about? There's a lot of us that have reports out there so you can also see what have others issued. But get to that first. What is the right message I'm going to issue and then from there, you can start targeting. How do I get to that type of information and build, ideally more in an efficient manner first, so you don't end up in that position that many of us are in today with the piles of systems and data and manual efforts that are trying to track a whole set of data.

Robert Nardi: One thing we didn't talk a lot about is, we touched upon a little bit, is around consistency. Consistency around organizations, but also comparability. To me, that's a big one. There's going to be a big challenge in comparing organization to organization, so I'd be curious to get your thoughts?

Nura Taef: I think that challenge has been highlighted for a couple of years now I would say where, as I said, there's a lot of ESG information that's already provided, but there isn't that consistency because there's multiple frameworks, there's multiple standards, that can be followed. So, it becomes very difficult to take that information and compare it organization to organization. Even those that are in the same industry, it's challenging.

So, the International Sustainability Standards Board was recently announced and established under the governance of the IFRS foundation. The intent of the ISSB is to establish this global baseline that's going to create consistency in reporting. They're establishing standardized disclosures, standardized metrics, qualitative or quantitative disclosures that are intended to capture the universe of totality of what any organization should be reporting on. And interestingly, they've issued two exposure drafts, where you can start to see how they're shaping this standard setting. And with this kind of global baseline, although there is still an ability for jurisdictions or industries to include supplemental information, having that global baseline really creates that consistent foundation that stakeholders need to have comparable information and have it really useful for decision making going forward.

Robert Nardi: How can technology help to overcome some of the challenges that were mentioned on the panel today?

Soodeh Farokhi: Well, I can speak about the strategy that we are taking at Nakisa as a solution provider for the enterprise market. In particular, on the HR side. We envision to create a flexible cloud data lake with necessary very complex compliancy tools. For sure, we'll focus on the social pillar first and we'll support multiple data types initially, so that we give analytics and reporting ability for our enterprise clients. We are envisioning to offer a flexible ESG reporting that can be compatible with multiple frameworks, not just one, and initially we'll focus on top ESG frameworks such as GRI or SASB. Then we might expand it as it's needed for our clients.

And of course, if it comes with the need, we might need to also expand it to other areas because governance also has some HR aspects related to it. But initially, this is the plan. And hopefully, because we already have D&I reporting and structure for analytics and progress, I think we just embed our reporting to ESG as it's the case in the market for enterprise solutions already. So that's the strategy that we are taking as a technology provider. Hopefully our clients will love that.

Check out more great content from Nakisa Connect 2022