Yes or no? To be or not to be? Chicken or egg? Nature or nurture? Vanilla or chocolate? Since the beginning of time, humans have faced important—and not so important —choices.

Often the proper answers to these questions depend directly on the unique circumstances of the situation that one finds herself or himself.

When it comes to the new IFRS 16 and ASC 842 lease accounting standards, organizations have an important choice to make between an asset-level accounting approach and a contract-level approach.

Understanding the differences between the two approaches, what they mean for your business, and whether it’s appropriate to utilize one or the other—or both—is vital to ensuring an effective lease accounting strategy.

What’s the Difference?

When it comes to differentiating between these two lease accounting approaches, the names say it all:

- Contract-level accountingIn contract-level accounting, transactions are recorded on balance sheets by generating the credits and debits for each contract. This approach works when there are no variations in the assets on a contract—think about certain real estate leases, for instance, where there’s only one asset, like a single piece of property.

- Asset-level accountingIn asset-level accounting, transactions are recorded by generating credits and debits for every individual asset. Factors like different lease start and end dates or different renewal options for individual assets make it difficult to calculate aggregate data.

Accounting Guidance Focuses on Asset-Level

While contract-level accounting might still be valid in certain specific instances, the new IFRS16 and ASC842 standards demand that organizations shift the vast majority of their accounting practices to asset-level

That’s because the standards require lessees to move all leases 12 months or longer onto their balance sheets. Under the new terms, organizations will need to treat each asset on their balance sheet almost as its own lease—accounting for many different factors like start and end date, residual value, purchase options, terms etc.

The overwhelming amount of data that now needs to be aggregated, recorded, and reported, means organizations need to have effective asset-level accounting strategies in place—and fast.

Technology to the Rescue

If complying with the new standards by implementing a broad asset-level accounting strategy seems overwhelming to you, you’re not alone.

With thousands of assets to account for on multiple contracts, each with their own specific terms, compliance is no easy task.

This is where effective lease administration software can help.

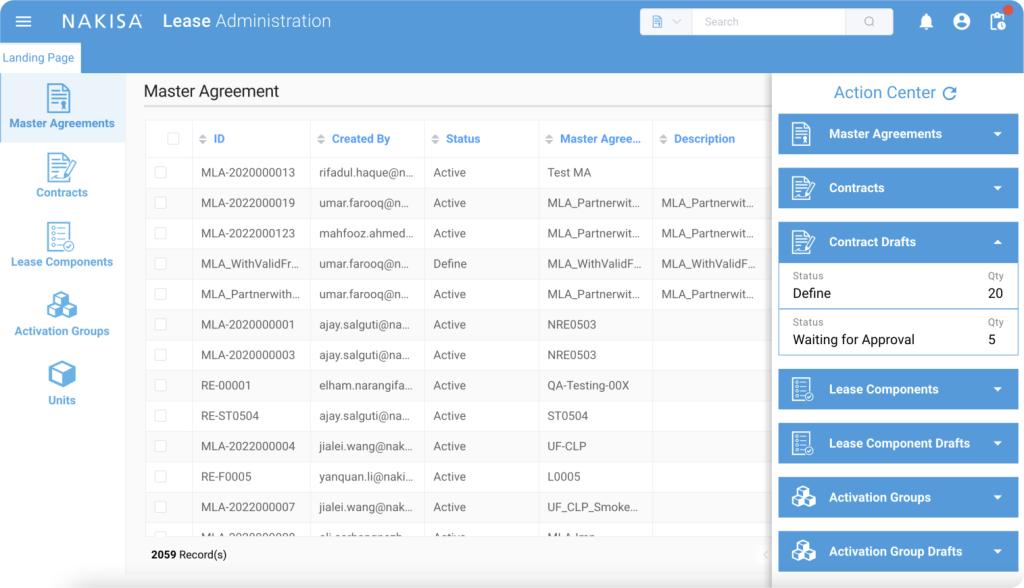

For instance, Nakisa Lease Administration, a cloud-based lease administration solution, helps lessees perform both contract-level and asset-level accounting through its Contract Hierarchy feature.

Users can easily visualize what assets are associated with which leases under what contract. Starting at the Master Lease Agreement level, users can see all of their applicable contracts under that lease agreement. Drilling down further, users can then see the multiple lease components associated with that particular contract, including the various asset classes included in the contract. From there, users can see the activation group, which are mini-leases associated with that particular contract. This view can then be expanded further to the unit level, where users can see the individual assets for that contract along with important terms and dates.

With so many necessary data points under the new lease accounting standards, organizations will need to implement strong accounting strategies in just a few short months. Lease accounting software like Nakisa Lease Administration can help effectively manage data and help you make the right decisions.