According to a 2017 report from Ernst and Young, “The new lease accounting standards could have far-reaching implications for oil and gas entities. The impacts go beyond accounting, to commercial decision-making and strategic financial decisions.”

But before oil and gas companies develop new financial and commercial strategies, they first need to ensure that they are in compliance with the IFRS 16 and ASC 842 lease accounting standards.

That’s no easy task.

Think about the assortment of leases required for a successful oil or gas operation: from land for resource extraction to equipment used for production and transportation to the facilities used for storage, natural resource companies are involved with hundreds or thousands of leases scattered across many geographic locations.

Under the new guidance, most—if not at all—of those leases are now brought onto balance sheets.

Given the operational complexity of these industries, oil and gas entities have some unique considerations to make in the waning months before the guidelines take effect.

Here are 4 key accounting considerations for oil and gas companies.

1. Do your service arrangements contain embedded leases?

Oil and gas companies employ the use of strategic service contracts as part of their operations. Service agreements may be used for transportation, drilling, or storage services. The new IFRS 16 and ASC 842 standards require companies to record leases as right-of-use assets based on economic benefit. This means oil and gas companies need to look at their service agreements and determine whether they contain embedded leases that must be placed on balance sheets.

2. Are there any leased assets in your bundled service contracts?

Material assets used in oil and gas operations, such as oil rigs, are often employed through a bundled service contract. This contract will often include the labor and other materials needed to operate the asset. If any parts of these agreements meet the definition of a lease, the new standards require companies to determine the standalone value of each element of the contract, both lease and non-lease.

3. How will you record embedded leases under an operating agreement?

It’s common for oil and gas companies to enter into joint operating agreements with other companies to use leased equipment like drill rigs. Under these joint operating agreements, organizations will need to determine whether to record these shared embedded leases on a gross or net basis.

4. How will certain triggering events affect your accounting strategy?

There are multiple reasons why an oil or gas company may decide to renew or not renew a lease. Changing economic conditions or new strategic goals often require the use of new or different assets.

When triggering events lead to changes in leases, the new guidelines require companies to reassess the lease’s operating and financial classification. Certain triggering events may also require a revaluation of the right-of-use asset of that lease and the lease liability. As companies work to comply with the new standards, they must ensure processes are in place for reassessing their leases when these triggering events occur.

Oil and gas operations are highly complex. The systems required to track and report on the leases that support these operations will, therefore, need to be very well-developed.

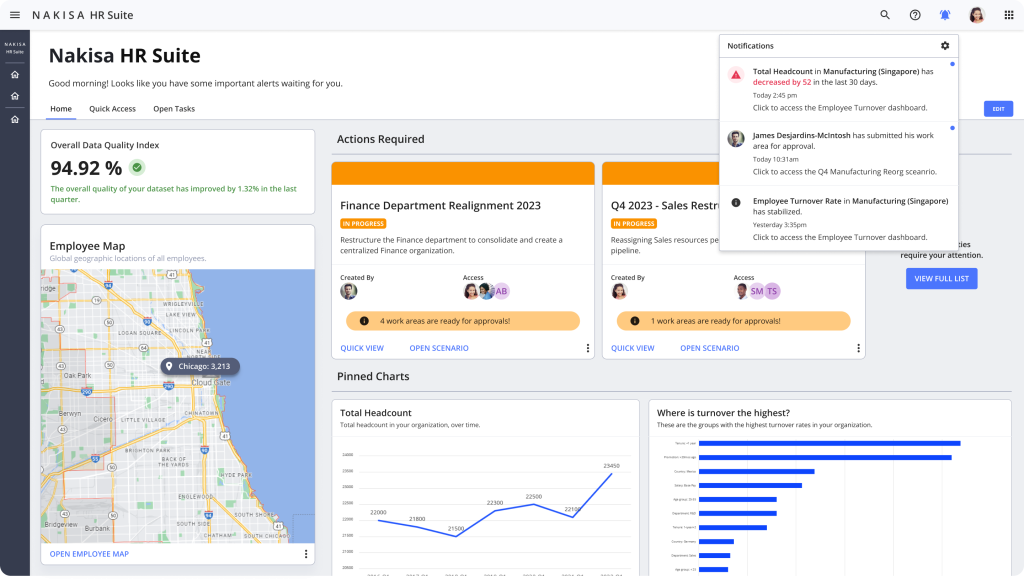

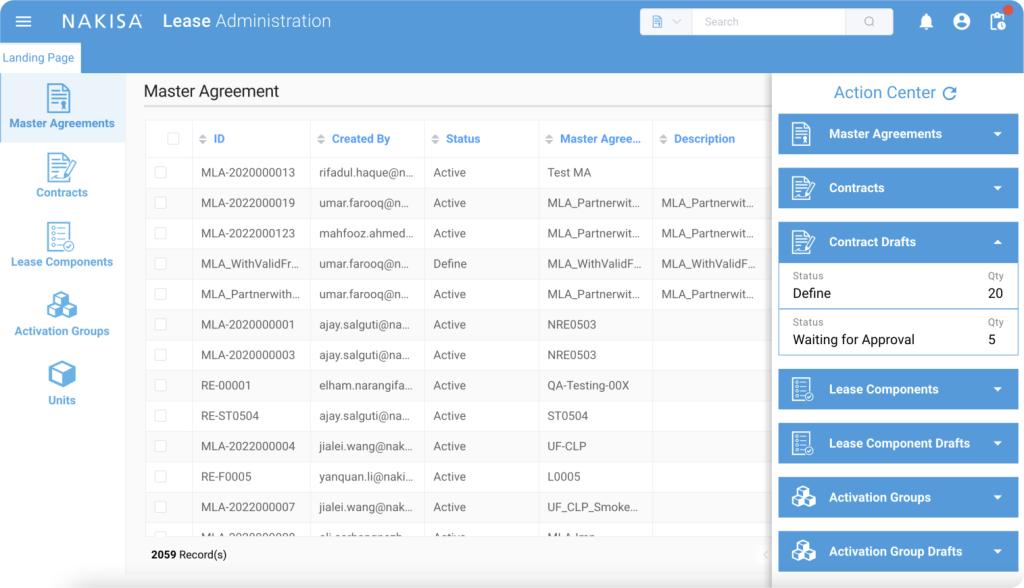

Nakisa Lease Administration is an end-to-end lease accounting software that helps simplify accounting under IFRS 16 and ASC 842 from initial recognition to disclosure reporting.

For more on the lease accounting complexities facing oil and gas companies and strategies for ensuring a smooth transition to IFRS 16 and ASC 842, check out our guide Smarter Lease Accounting for Oil and Gas.