Pharmaceutical companies know that research and development (R&D) projects can last for years before generating cash. A 2015 study by PhRMA revealed it takes at least 10 years for a new medicine to complete the journey from initial discovery to marketplace, with less than 12 percent of drugs ultimately getting approved for commercialization. The average R&D cost for each successful drug is estimated to be US$2.6 billion.

This explains why the pharmaceutical industry spending on R&D is so impressive. For instance, in 2020, Merck was ranked the top global spender with US$13.6 billion in expenses related to R&D. These costs include laboratory research and clinical trials, with much of the spending going into medical equipment such as anaerobic chambers, microplate readers, and flow cytometers, to name a few.

However, while spending on medical equipment is a necessary evil, remaining profitable is one of every business’s top priority. Consequently, many biotechnology and pharma companies have increasingly been adopting medical equipment leasing as a mean to get the best technology while keeping their books balanced.

That introduces a whole new set of challenges. Managing a growing number of lease contracts can turn into a wild adventure, unless you use the right tools. Here is how you can improve your leasing practice.

Include lease accounting and compliance in your strategy

A few years ago, leased property and equipment were classified as operational and present in financial statements’ footnotes. Today, they have made their way into the balance sheet thanks to new accounting standards. As a result, organizations require an end-to-end lease accounting and administration solution that acts as a central repository for the right-of-use assets and lease liabilities. While many countries have been working on local GAAP standards, IFRS 16 and ASC 842 which encompass most lease compliance guidelines remain the reference standards internationally.

Pharmaceutical companies must consider the local and international accounting standards when planning for medical equipment leasing. The truth is that accountants are struggling to master these standards and adapt their existing tools to achieve compliance. A May 2021 press release by Deloitte explained that one in five private company executives still felt unprepared to comply with the ASC 842 standard. This includes businesses in the life sciences industry.

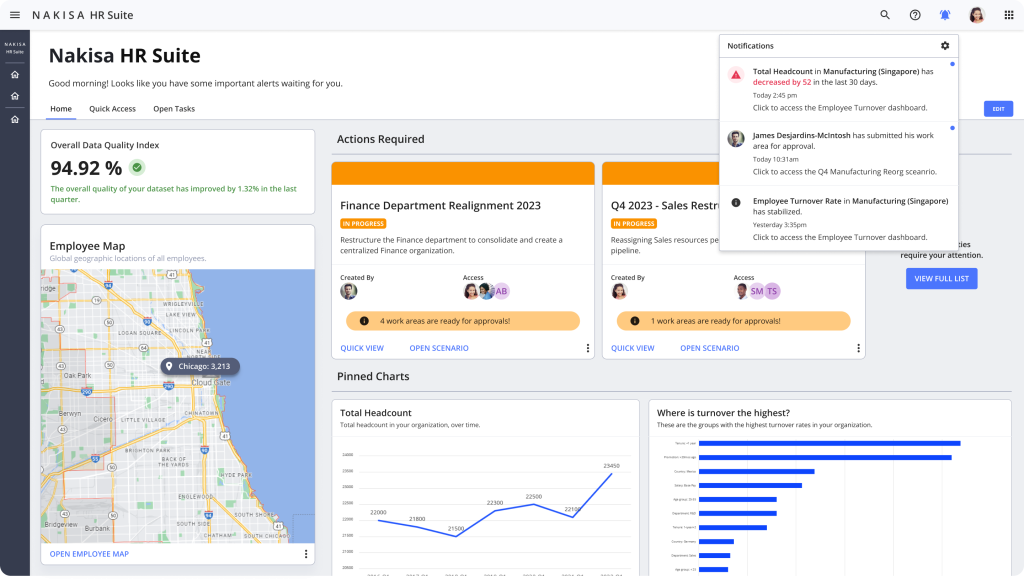

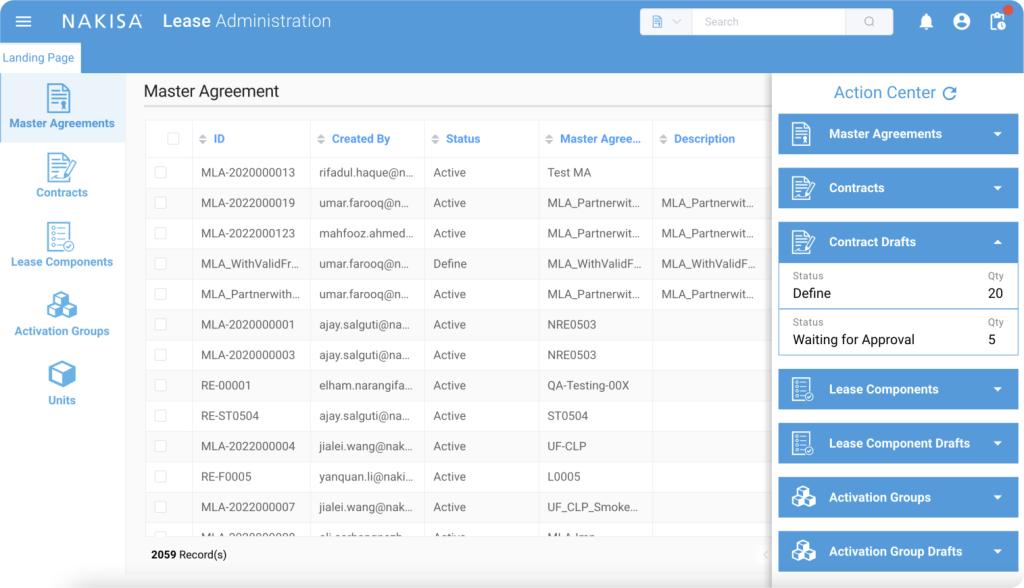

At Nakisa, we have been building finance solutions specifically for compliance with lease accounting standards. Nakisa Lease Administration captures all the requirements for lease compliance under IFRS 16, ASC 842, and GASB 87, providing your accountants a central platform for lessor and lessee accounting. The end-to-end process includes data abstraction and lease determination, initial recognition of right-of-use assets and lease liabilities, subsequent measurement for amortization, interest accrual and payments, lease event management, and a full suite of disclosure reports ensuring compliance. It includes generic management and reporting for other local GAAP.

Go for a lease management solution that is asset agnostic

Pharmaceutical companies have a diverse lease portfolio that includes not only equipment, but also fleets and properties. In a recent context where organizations like Johnson and Johnson, AstraZeneca, and Pfizer were under pressure to accelerate R&D and commercialize a new vaccine in record time, Contract Development and Manufacturing Organizations (CDMOs) played a major role to help deliver at scale.

Scaling up when you count on leasing means the number of contracts you handle can grow fast, whether you lease in or out. This can pose a challenge for corporate lease professionals and accountants. Relying on spreadsheets and legacy software is not possible when you have hundreds to thousands of leasing contracts to manage. First, spreadsheets have their limitations, especially when shared among different users, making change audits almost impossible. Second, legacy applications do not offer the ability to manage all types of leased assets. Third, managing the diversity of lease terms and conditions is unbearable with these solutions. Finally, reconciling data is time-consuming and error prone in these conditions.

Pharma companies require a leasing solution that is built to scale with the rapid growth of their operations. When planning for your medical equipment leasing strategy, think beyond and look for a centralized platform that can sustain the size and diversity of your portfolio, automate activities, and allow to manage large volumes of assets whether for scheduling recurring posting jobs, applying mass lease events, or any workflow processes such as reviewing and approving contracts. Furthermore, select a solution that allows you to keep an audit trail of changes made to both the frontend and backend of the application, such as configuration and master data changes, to comply with IT General Control (ITGC) requirements.

Nakisa offers a single platform made for large, complex portfolios that include real estate, fleet, and equipment lease contracts. The asset agnostic architecture provides a concise and user-friendly contract activation process that enables accountants and lease administrators to cover all requirements for all asset types under a single workflow. The system provides an audit trail for every step of the workflow including change management, audit logs, a validation framework for contract uploads and remeasurements, and error reports for batch processes. Finally, Nakisa Lease Administration will act as a subledger that integrates seamlessly with popular ERP products such as SAP ERP and Oracle Fusion Cloud.

Get the most out of your medical equipment leasing contracts

On one hand, biotechnology and pharma companies have found one major advantage through leasing—flexibility. They don’t have to pay the high price to get the latest technology innovations so they can better adapt to the company urgent needs. With leases, there is no need for significant upfront investment, which has a positive impact on capital expenditures. With easier access to innovative laboratory equipment, companies can speed up R&D efforts, providing a competitive advantage in a crowded industry.

On the other hand, organizations have a secret weapon to make the most out of their leasing strategy—tracking the terms and conditions (T&Cs) of lease contracts. When you have clear visibility over your portfolio, you will never miss critical dates. For instance, you will be able to exercise an option to extend or terminate a lease within the appropriate timeframe. You will stay in control of your leases, in line with your business goals, whether you are leasing in or out.

Here’s the bottom line: keeping up with terms and conditions in a dozen of contracts may sound like an easy game, but it simply becomes impractical with a large portfolio of disparate contracts.

This is where a powerful platform like Nakisa Lease Administration makes more sense, and the user interface has a lot to do with it. First, when creating the lease contract in the system, you can set notification dates so the appropriate users receive alerts and can make the right decisions related to contract extension or expiration for instance. Second, planning and budgeting are simplified, thanks to built-in financial reports like the Contract Expiration Report that gives you an overview of expiring contracts within a selected reporting period. It will also indicate whether or not the contracts have existing options. Third, you can use the Data Quality Integrity Reports functionality, to validate all the options in the contracts’ terms and conditions, including extensions, purchases, terminations, financing terms, payment terms, and more, and identify any gaps in your finance strategy.

Is there any future for medical equipment leasing?

The answer is simple—absolutely. The 2021 Predictions & Trends produced by PutmanMedia highlights different facts on the biotechnology and pharma industry. Pfizer CentreOne’s Pipeline Development and Innovation Lead Nicole Strauss has stressed that “there is going to be a continued shift away from the large blockbuster product volumes and increasingly CDMOs will produce at smaller manufacturing scales, which will require new ways of working.” If you are in the industry, don’t miss out on the opportunity to move fast while keeping costs low.

Find out more about Nakisa Lease Administration at intranetorgchart.com/finance.