The year of reckoning for GASB 87 compliance is upon us and it’s time for government entities to start mirroring the new leasing standards deemed “the biggest ever accounting change.” Issued by the Governmental Accounting Standards Board, government bodies are now required to classify all leases as financing arrangements going forward.

In an earlier blog post, we discussed how bringing the financing leases into the Balance Sheet was similar to the ASC 842 and IFRS 16 regulations. In this post, we will be looking at an everyday situation and how these changes come into play for bookkeepers around the world.

Understanding GASB 87 Calculations

To show the GASB 87 calculations in practice, let’s look at an example. For a lease contract with the following details:

- Contract commencement date: July 1, 2021

- Contract end date (estimated): June 30, 2024

- Annual payment: $10,000 (in arrears)

- Initial direct cost: $5,000

- Cash incentive: $2,000

- Incremental borrowing rate: 8%

Step 1: Calculating the Lease Liability

To get started, the lessee must calculate the initial value of the lease liability by discounting the series of lease payments using either its contract’s implicit rate or the incremental borrowing rate (on the date of the contract inception). Another thing to keep in mind is when calculating the value of the lease liability, the lessee should consider cash outflows on or after the contract commencement date.

From our example, firstly we would arrange the lease payments in order of payment date:

| June 30, 2022 | $10,000 |

| June 30, 2023 | $10,000 |

| June 30, 2024 | $10,000 |

To arrive at the lease liability value, the present value of the above payments must be discounted at 8% (with a consideration that interest is calculated in arrears). This presents the lease liability value at $25,331 during inception.

To record the lease liability and portion of the right of use (ROU) asset derived from the liability value, the following bookkeeping entries must be made:

| Dr. ROU Asset | $25,331 |

| Cr. Lease Liability | $25,331 |

Step 2: Calculating the ROU Asset

Next, the ROU Asset value must be tackled. To arrive at this, the starting value of the initial lease liability would have to be adjusted with the addition of any prepayments (made before the commencement of the lease term), reduced by any lease incentives (received at or before the commencement of the lease term) and increased by any initial direct costs incurred to place the lease asset into service.

In our example, with the starting point of the lease liability value of $25,331, the lessee must simply add the value of the initial direct cost then deduct the value of the cash incentive received to arrive at the ROU Asset’s Gross Book Value (GBV) during inception. The calculation would be as follows:

$28,331 (Asset GBV) = $25,331 (Lease Liability) + $5,000 (Initial direct costs) – $2,000 (Cash Incentive)

The following journal entries are necessary to adjust the value of the ROU asset up from the initial booking made with the lease liability, in order to account for the initial direct costs and cash incentive:

| Dr. ROU Asset | $3,000 |

| Dr. Accrued Income | $2,000 |

| Cr. Deferred expense | $5,000 |

Step 3: Calculating the Interest Expense

The next step involves calculating the interest expense for Period 1, which in our example is FY 2021-2022:

$2,062 (periodic interest expense) = $25,771 (principle balance of the lease liability) * 8% (incremental borrowing rate)

Subsequently, the booking for the accrual of interest expense must be made on the last day of the accrual period (June 30, 2022 for period 1) and should be reflected as:

| Dr. Interest Expense | $2,026 |

| Cr. Accrued Interest | $2,026 |

More to Follow

I hope that helps clarify the impact of these changes. In the Part 2 of this blog series, I will be recounting the next steps in the GASB 87 calculations that will involve estimating the depreciation and amortization schedules.

Stay tuned!

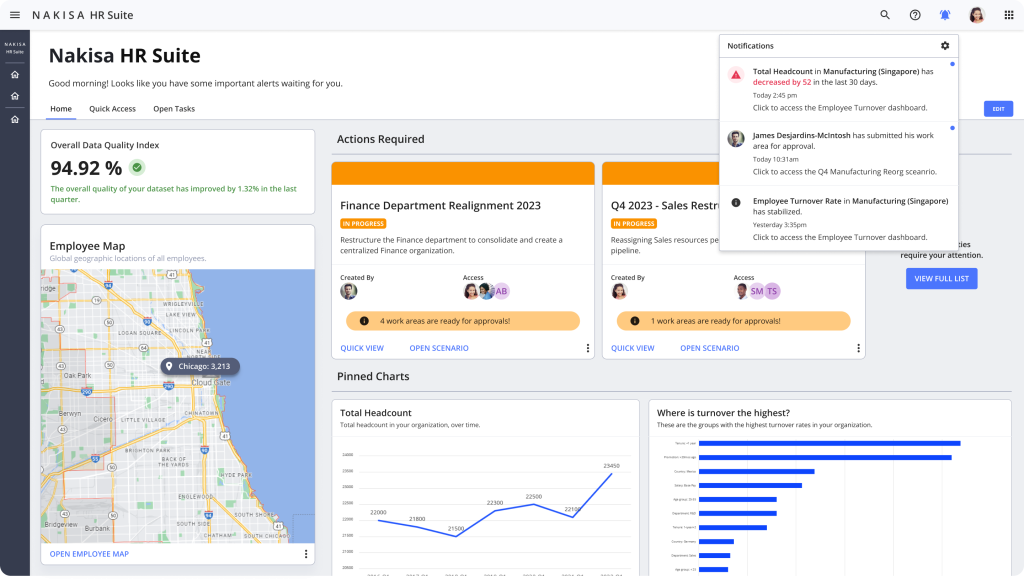

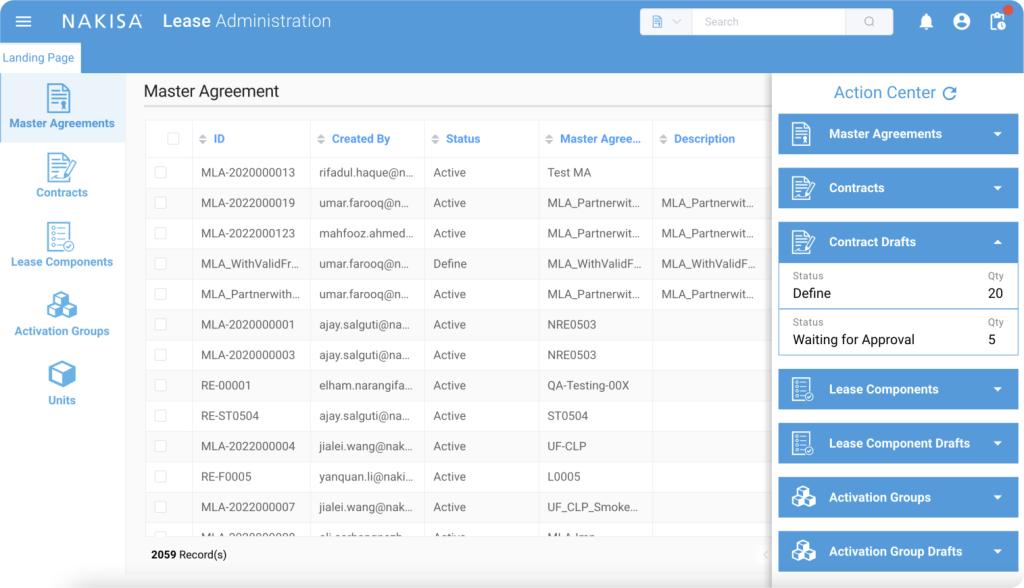

If you are interested in learning more about Nakisa Lease Administration, please feel free to contact us directly.