In part 1 of this blog, I had started outlining the steps for GASB 87 calculations, discussing the math behind lease liability, ROU Asset, and interest expenses associated with lease calculations.

In this post, I will continue with the depreciation and amortization expenses as well as briefly touch on “event-related modifications.”

Step 4: Calculating the Depreciation Expense

To measure the annual depreciation expense, the formula for periodic straight-line depreciation must be used.

By using the following formula for periodic straight-line depreciation, the annual depreciation will be calculated as follows:

$9,590 (Periodic deprecation) = $28,771 (ROU Asset GBV) / 3 (Periods in the lease term)

The bookkeeping entries to account for the periodic expense can be entered on the last day of each period as follows:

| Dr. Depreciation Expense | $9,590 |

| Cr. Accumulated Depreciation | $9,590 |

Below is a comprehensive deprecation chart over the life of the lease:

| Period Accrual Date | Gross Book Value | Depreciation | Accumulated Depreciation | Net Book Value |

|---|---|---|---|---|

| June 30, 2022 | $28,771 | -$9,590 | -$9,590 | $19,181 |

| June 30, 2023 | $28,771 | -$9,590 | -$19,181 | $9,590 |

| June 30, 2024 | $28,771 | -$9,590 | -$28,771 | - |

Step 5: The Lease Liability Amortization Schedule

Next, the amount of expense attributed to the monthly deprecation of the ROU asset is calculated by dividing the value of the initial Leased Asset by the lesser of financial lease term or the asset’s useful life. It should be noted that if the lessee is provided with a purchase option that is reasonably certain to be exercised, the asset’s useful life will automatically become assumed in the depreciation calculation.

This brings the closing lease liability balance to the difference between the opening and principle amortized for each period or $18,833 in Year 1 of our example. Below is the full annual amortization schedule for our sample contract:

| Date | Opening Lease Liability | Accumulated Interest | PMT | Principle Paid | Closing Lease Liability |

|---|---|---|---|---|---|

| June 30, 2022 | $28,771 | $2,062 | $10,000 | $7,938 | $18,833 |

| June 30, 2023 | $18,833 | $1,427 | $10,000 | $8,573 | $9,259 |

| June 30, 2024 | $9,259 | $741 | $10,000 | $9,259 | - |

GASB 87 Lease Event/Modification Calculations

Finally, the lease accounting calculations involve remeasuring the liability, future lease payments and ROU asset values as affected by events. One of the most common adjustments involves accounting for a change in the incremental borrowing rate and its impact on the lease liability.

The value of the remeasurement becomes the difference between the carrying value of the original lease liability and the recalculated lease liability on the date of the event. In most cases, the leased asset should be adjusted by the difference between the remeasured liability and the amount immediately before the lease modification.

In cases when an “event” results in a full reduction of future lease payments and/or a full reduction of the ROU asset, then the difference between the lease liability and ROU asset carrying value should be carried over to the Profit and Loss Statement at the end of the reporting period.

Optional Step 6: Calculating Adjustments

In our example, additional right of use has been granted to the lessee beginning on the first day of Year 2. As a result of this, the future lease payments for this contract will increase by $800 per year. Subsequently, the present value of the amended payments will reshape the lease liability value at $19,259 on July 1, 2022.

The difference between the old and new lease liability value on the date of the remeasurement should be booked to revalue the balance sheet values with the following entries:

| Dr. ROU Asset | $1,427 |

| Cr. Lease Liability | $1,427 |

Finally, new depreciation chart and lease liability amortization tables must be created for FY 2023 and 2024 to arrive at the relevant accrued interest, principle, accumulated depreciation and NBV and GBV values.

Thoughts on GASB 87 Compliance

As a Technical Accounting Advisor at Nakisa, I’ve worked closely with many organizations to get them ready for IFRS 16 and ASC 842 – the lease accounting standards meant for private and publicly traded companies. And the long and short of the process to compliance is that it can be tedious, as might be evidenced from the lengthy calculations and recalculations necessary (in the event of modifications).

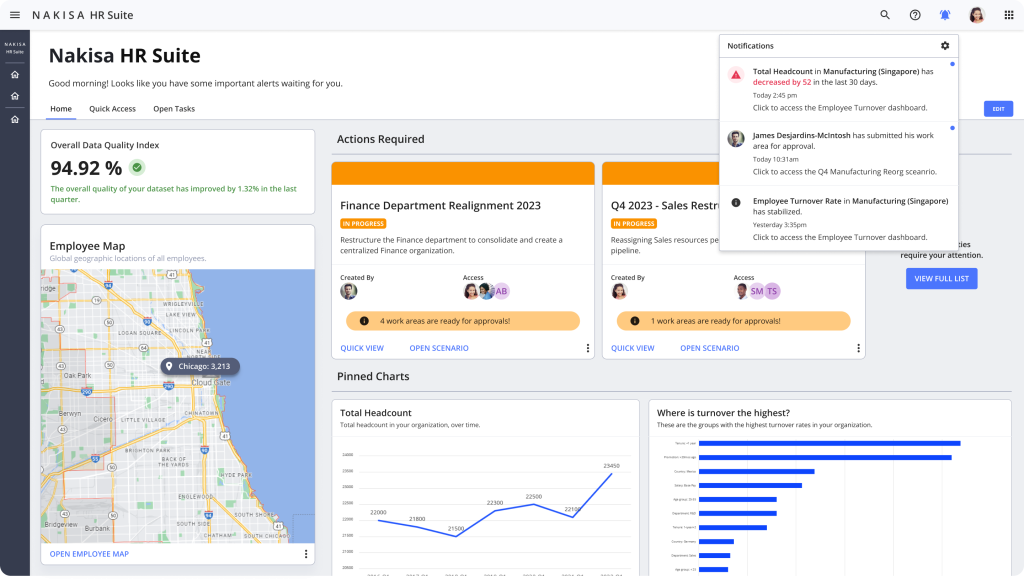

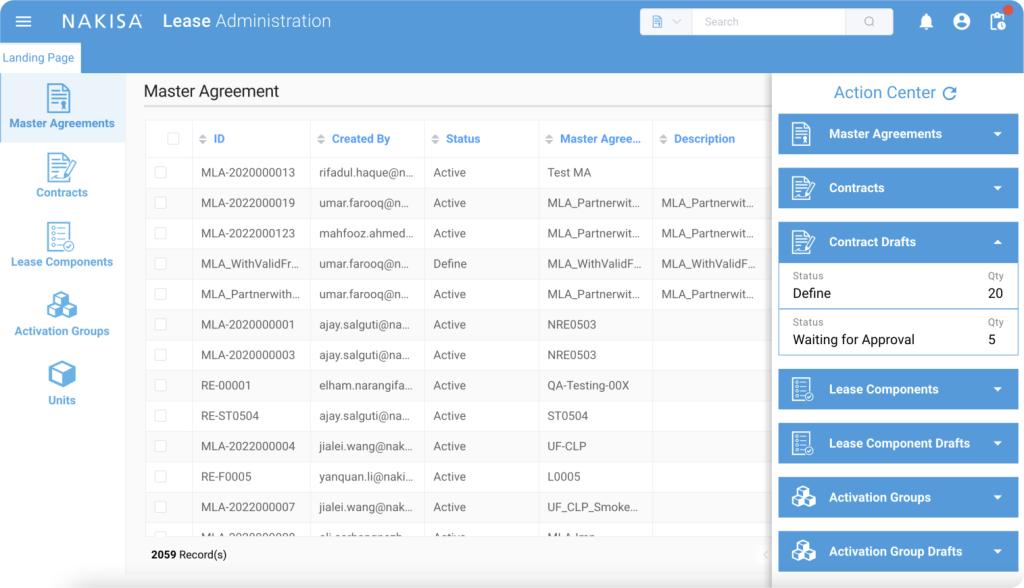

Lease calculations are heavily prone to human error, which is why we’ve developed a full end-to-end lease accounting solution to fit all your GASB 87 compliance needs. If you are interested to learn more about our solution, I would invite you to visit this page.