As we reach mid-2019, public companies are wrapping up their compliance efforts for the new ASC 842 and IFRS 16 lease accounting standards which officially took effect for public organizations in January 2019.

Now, it’s private companies’ turn.

Private companies have until January 2020 to ensure they comply with the new standards. While a year may sound like a long time, public companies who have been working to meet their own deadlines might tell you otherwise.

In a Deloitte poll of private company executives conducted in April 2018, only 33 percent of those polled said their organizations would be able to adopt the new lease accounting standards on schedule.

As the countdown begins, here are three important tips to help privately-held companies ramp up their compliance efforts.

1. Understand the real impact of the new standards

According to the Global Lease Accounting Survey released by KPMG in January 2019, just months prior to the deadline, 18% of companies surveyed still did not know what the final cost of their implementation efforts would be. Under the new rules, lessees will have to identify a “right-of-use” asset and lease liability for nearly every one of their leases. In other words, the new standards represent big changes for private companies who lease assets and with these changes, come rising costs.

2. Start identifying your “embedded leases” as soon as possible

One of the biggest changes under the new standards is that companies are now required to identify embedded leases in contracts. These are the parts of a contract that identify assets that can be used and controlled. Contracts that had not been accounted for as leases in the past, may, in fact, meet the new definition of a lease. For many companies, this can mean hundreds of leases will now need to be brought onto balance sheets under the new standards.

According to a 2017 KPMG survey on the difficulties of adopting the new standards, nearly half of respondents (49 percent) said that identifying embedded leases was the biggest challenge they faced. If your organization hasn’t yet thought about how embedded leases will affect your lease accounting strategy, you’re probably already falling behind.

Read our blog on how to identify embedded leases.

3. Identify the right technology to help with the transition

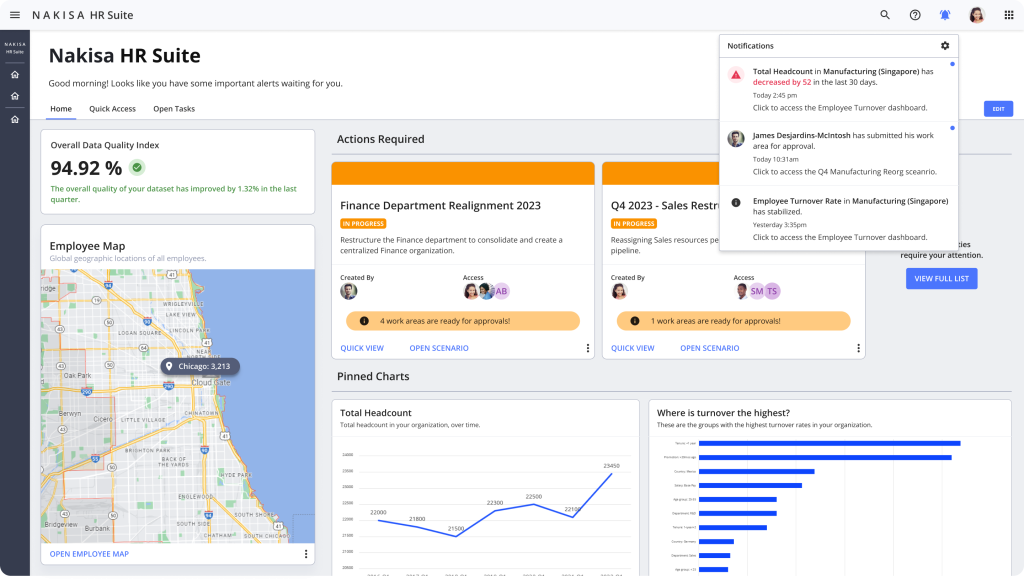

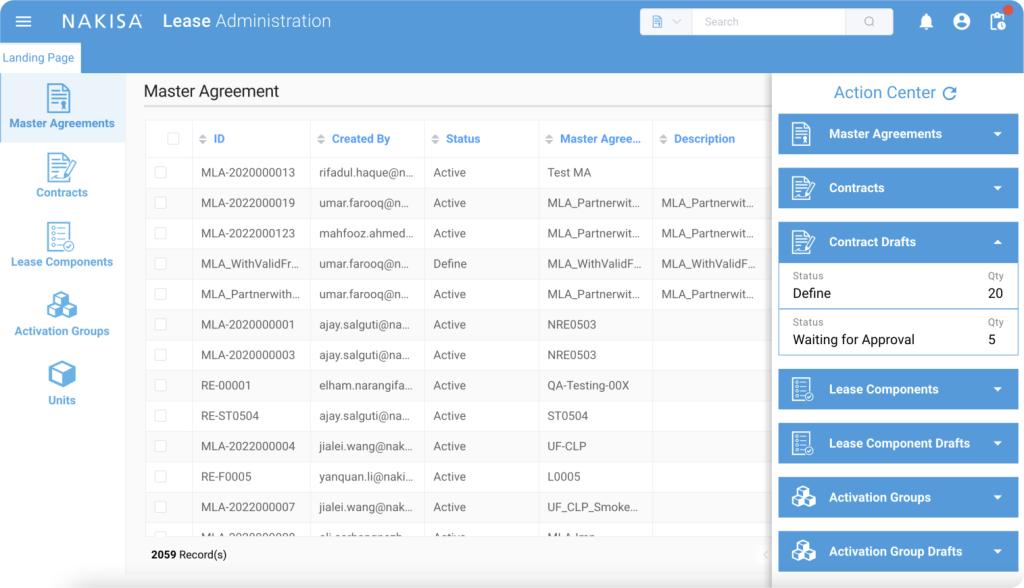

Many organizations are quickly learning that the complexity of the new lease accounting standards requires more robust accounting systems and strategies than those currently in place. There are new lease accounting solutions on the market that help organizations gather data and streamline compliance with the new standards.

Remember: Any solution you choose should maximize the efficiency, visibility, control, auditability, and cost-effectiveness of your company’s lease administration, while also assuring compliance with the new standards.

Here are four important questions you should be asking yourself as you assess potential lease accounting systems:

1. Can the system help shorten your timelines?

Effective leasing systems will help speed up your ability to comply, not slow you down due to complex implementation or integration processes.

2. Does the system reduce risk?

Consolidating your data and identifying all lease contracts will be a challenging —even overwhelming— undertaking with lots of room for error. Make sure you choose a system that will simplify this process.

3. Does the system eliminate dependencies?

Integration with your ERP and other systems will take time and effort—and customized systems can create unnecessary complexity. Any lease accounting system you choose should provide the option for quick, standalone deployment.

4. Will the system achieve compliance with minimal effort?

Effective lease management systems will allow your team to comply with the new standards while limiting the amount of manpower and resources needed to do so. Choosing a proven solution will be crucial, not only in compliance efforts but in freeing up employees to focus on work that really matters.

The clock has started for private companies to begin their compliance efforts with the new lease accounting standards. The truth is, the clock started a while ago. As we move through 2019, are you ready to accelerate your efforts to meet the approaching deadline?