There’s not a whole lot of terms in lease accounting that are self-explanatory but evergreen leases may be one of them.

Evergreen leases are those that are automatically renewed until one party—either the lessor or lessee--terminates the lease contract.

Much like an evergreen tree never loses its leaves, evergreen leases have no fixed contractual end date; the life of the lease is indeterminate. For example, a lessee might be leasing vehicles from a lessor and those leases are automatically renewed on a month-to-month basis. The end date is not written in the contract, the lease may terminate in one month or one year.

As with many other issues under ASC 842 and IFRS 16, reporting requirements for evergreen leases are not explicitly laid out in the new standards. This leaves figuring out exactly how and where to report on evergreen leases up for interpretation.

Your organization will need to determine how to report on evergreen leases based on best practices and your unique situation.

There are common interpretations among subject matter experts on how evergreen lease agreements should be handled under IFRS 16 and ASC 842. If you’re looking to better understand how to report your evergreen leases under the new standards, there are a few things to consider.

Assessing your evergreen lease

The first step in determining the process of reporting an evergreen lease is to determine whether the lessee (the person who holds the lease), the lessor (the person who leases the property or equipment to the lessee), or both have the right to end the lease. Based on this determination, accounting strategies will vary.

If the lessee has the sole right to terminate the lease, the initial measurement of the lease liability is based on how long the lessee is expecting to lease, rather than the lease term defined in the terms and conditions of the current contract.

If both lessor and lessee have the right to terminate the lease, or only the lessor has the right to terminate, the following would occur:

- At the end of the non-cancellable term, the lease contract is automatically renewed with both parties--lessor and lessee. This auto-renewal is for an indefinite period of time until either party decides to end the lease. In this case, a lease modification may be applied in order to reflect a new lease extension on the last day of the non-cancellable period.

- Periodic lease remeasurement, like month-to-month, will also occur. In this case, the lease liability and ROU asset will be re-measured each month. If you are concerned about impacting your balance sheet because of this particular month-to- month renewal scenario, then a service contract may be entered in your lease accounting solution.

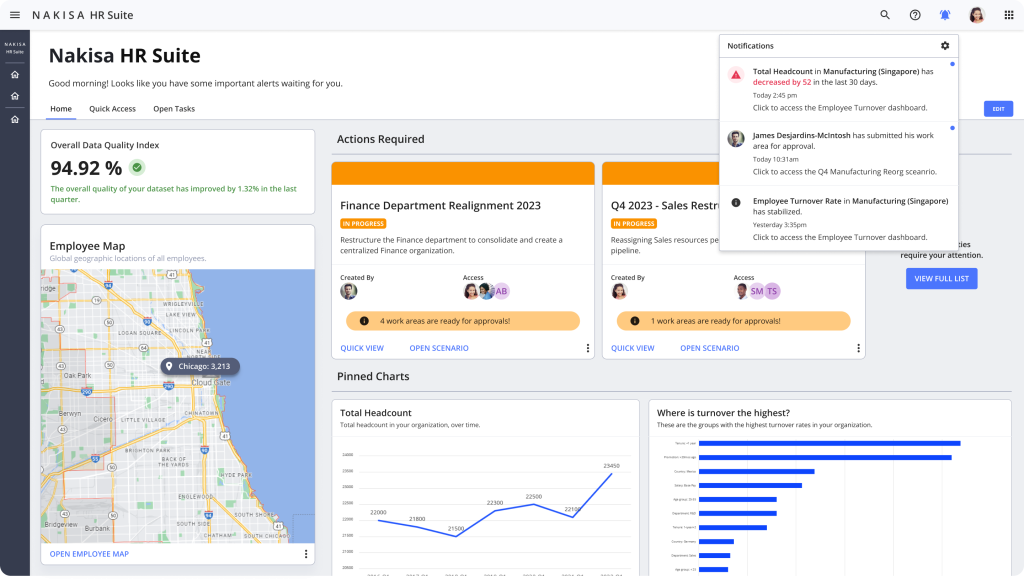

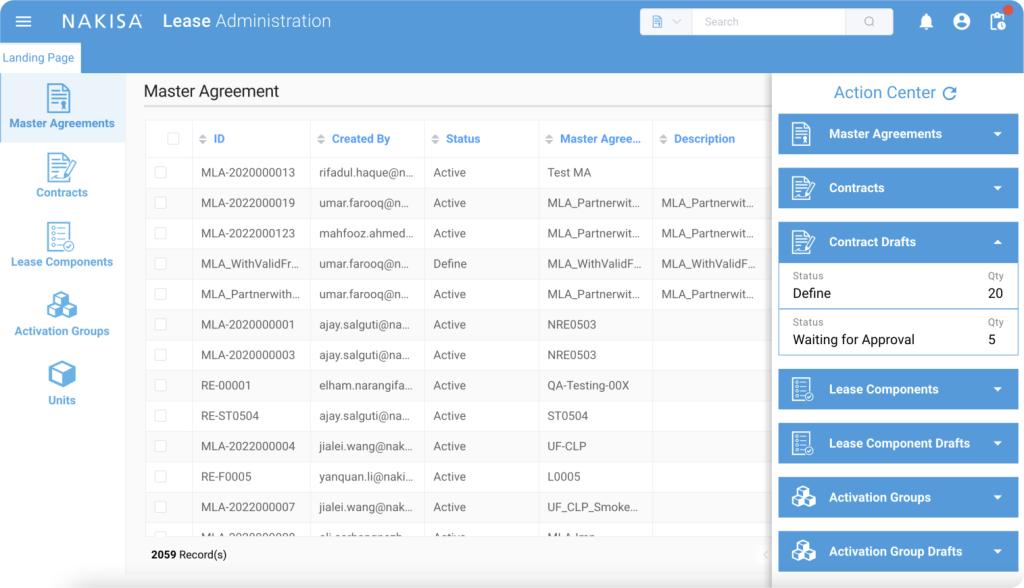

If you don’t have a comprehensive lease accounting solution in place, you may be at a disadvantage in how you track, measure, and report evergreen leases under the IFRS 16 and ASC 842 lease accounting standards. Solutions like Nakisa Lease Administration can help make that process easier.

Nakisa Lease Administration is a purpose-built end-to-end lease accounting and management solution that centralizes company-wide lease data. The solution helps organizations manage global lease portfolios, gain strategic insights into financial data, and streamline lease accounting operations.