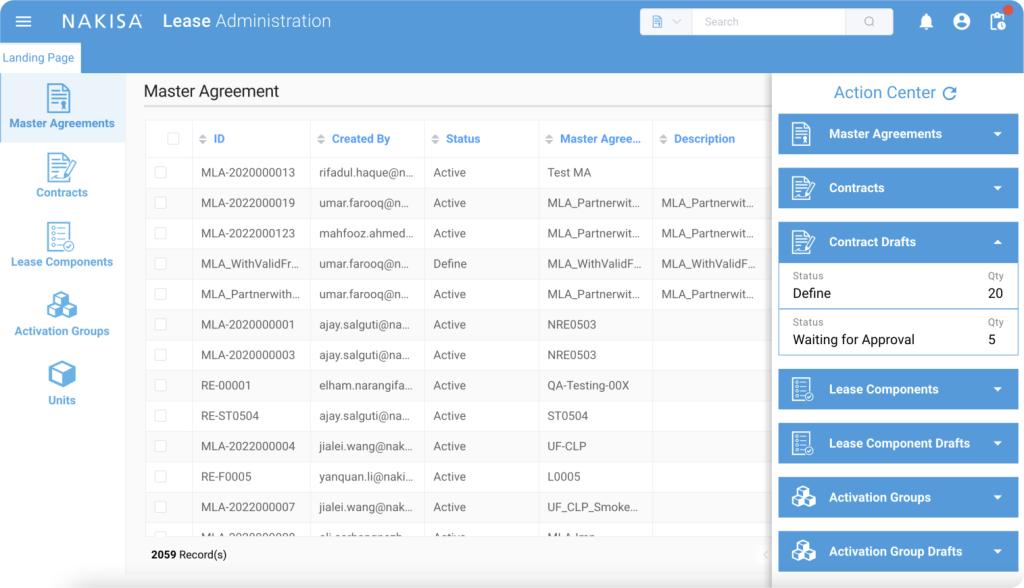

It’s a problem faced by many growing organizations: How do you integrate disparate enterprise resource planning (ERP) systems? As businesses expand and acquire other enterprises, they also absorb and expand their ERPs. Integrating them can be an exhausting process that drains resources—especially if you maintain a traditional on-premises system. But there’s a better alternative. In a three-part interview, Nakisa’s Chief Technology Officer, Faraz Ahmed, explains how Nakisa Lease Administration’s cloud-native solution can reduce an arduous years-long ordeal into a straightforward process that can be completed in months, if not weeks.

Don’t miss parts two and three of this interview.

Given the current global landscape and lease accounting requirements, how would you rate the importance of a lease accounting solution having global ERP integration and why?

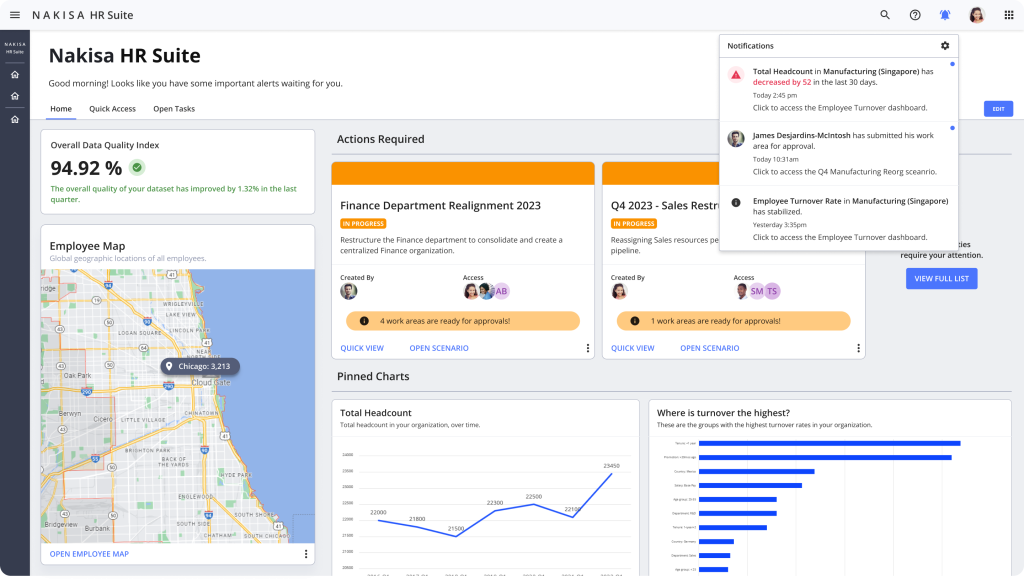

I’ll try to explain the whole situation. Lease administration and accounting regulation changes made a couple of years ago significantly affect how companies treat their leased assets. Before they were just expenses. Now they actually end up in their balance sheets, so we need to recognize assets and liabilities against those. This affects many departments and areas in a business. From accounting to IT, it’s a very big change. Now IT needs to look for software that can manage large amounts of assets in a new way.

The chosen software will need to be fully in sync with the company’s financial systems. In 90 percent of our customer base, these financial systems are the ERP systems they use. In some cases, however, these systems are just CRM systems. To adhere to the current lease accounting standards, ERP integration becomes a fundamental challenge because these types of projects take a very long time and a lot of resources. In this case, we believe that what’s best is a cloud-native enterprise solution that provides most of the integration capabilities, and all the compliance capabilities, out of the box. It’s pretty much a turnkey solution, requiring the least amount of effort to be compliant, go live, and generate financial reports as mandated by the regulations. As a side note, it’s not only financial reports that are needed. There are a variety of other disclosure reports that need to be produced to achieve compliance.

ERP integration poses a big challenge in the context of the global pandemic as well. The crisis is having an impact on peoples’ personal lives, and companies are struggling with getting more things done in less time. When it comes to software integration, organizations are required to mobilize their already-stretched IT and finance teams. But Nakisa sees cloud-native software as the solution to that problem.

Interesting. In terms of a cloud-native solution versus on-premises—what would you say is the key advantage of cloud native?

Let’s look at a practical example that will help us understand how much time and money a cloud-native application can save. Whenever an enterprise acquires software, it must go through multiple internal activities. IT teams will have to provision their own servers which consist of hard drives, memory, and CPUs, and they will need to establish proper network security. They will also need their own database servers and must look into total surface area security. Only then can they acquire the software, install it, and configure it. With cloud-native software, they do not have to worry about provisioning computer servers, database servers, networks, disk space, and many other things. The surface area security comes built in.

On-premises software comes with recurring overhead—IT will have to perform constant backups or even recoveries in the event of force majeure. This too is rendered moot thanks to the automation that cloud-native software provides. It will automatically back itself up, and disaster recovery protocols are automated as well. You can say the software is self-healing.

IT still remains in control of cloud-native software, but the team can save time by limiting their involvement to user management and status monitoring.

At a glance

- Companies, and their ERP systems, are growing with every acquisition and expansion. In-house integration of these systems requires months of work on the part of IT and finance teams.

- Current lease standards require enterprises to source lease accounting software that makes ERP integration, and therefore compliance, simple and automated.

- A cloud-native solution like Nakisa Lease Administration requires little overhead and is fully secure out-of-the-box, making it more convenient and less expensive than on-premises software

Don’t miss parts two and three of this interview.

Get in touch to learn more about how Nakisa Lease Administration can easily integrate and turbocharge your ERP.