UPDATE: Due to the COVID-19 pandemic, Statement No. 87, Leases, along with any related implementation guides, are postponed by 18 months until fiscal years beginning after June. 15, 2021, or fiscal year 2022 for all June and September year-ends. Governments and stakeholders are encouraged and permitted to apply the provisions as soon as possible.

As the end of 2019 fast approaches, government entities are counting down to the effective date of GASB 87.

The new standards are effective from reporting periods starting December 15, 2019 and local US governments are required to comply starting July 1, 2020. ASC 842 and IFRS 16 represented major changes for business organizations, but GASB 87 also represents some significant changes in how government agencies report leases.

As the countdown continues, agencies should have a clear understanding of what the changes mean for their organizations—and how they can best comply.

With this in mind, here are answers to four key questions about GASB 87 and what it may mean for your organization.

What’s Changing Under GASB 87?

While it’s important for you and your team to do a deep dive into the new standards to understand their effect on your entity’s individual lease accounting approach, some of the major changes in GASB 87 come under lessee accounting practices:

- Lessees should recognize the lease liability and lease asset at the beginning of the lease term. This would not apply if you are dealing with a short-term lease or if ownership of the underlying asset is transferred.

- According to the new rule, lease liabilities will now be measured at the present value of payments expected during the lease term and lease assets should be the amount of the initial measurement of the lease liability, along with any payments that are made to the lessor before or right at the start of the lease term and certain direct costs.

- The new standard requires lessees to reduce their lease liability as they make payments and recognize an outflow of resources for interest on the liability.

- Lessees should amortize the lease asset over whichever time period is shorter between lease term or the useful life of the asset.

- Notes to financial statements should include a leasing arrangement description, schedule of future lease payments, and the amount of lease assets being recognized.

Are There Any Exceptions for the New Standards?

Yes. Leases for certain assets or contracts are not applicable to GASB 87, including:

- Intangible assets; copyrights, mineral rights, or software and patents

- Inventory

- Biological assets; plants, animals, and timber

- Service contracts; service concession agreements or arrangements

- Short-term leases under 12 months

GASB 87 and Other New Lease Accounting Standards

While the standards were meant to streamline lease accounting in the government sector, it may mean added complexity for certain organizations. GASB’s current lease rules were formulated using standards developed by FASB. However, the new standards will make GASB’s and FASB’s approach to operating leases different. In particular, GASB 87 classifies all leases under one finance classification whereas FASB’s ASC 842, has two classifications: finance and operating.

Organizations that fall under the IFRS 16 standard follow a similar single classification. However, unlike IFRS 16, the lessees do not need to remeasure the ROU Asset and Lease Liability when there is a change index, and the incremental payment due to changes in index are expensed. This is similar to the ASC 842 approach.

Are There Tools to Help Keep Track of the New Standards?

If you’ve read any of our blogs leading up to the implementation of ASC 842 and IFRS 16, you know that adhering to new lease accounting standards doesn’t happen overnight. If you’re organization has only a few leases in your portfolio that will be affected by GASB 87, and you’re used to handling your lease accounting in a simple program like Excel, you may be able to continue this way.

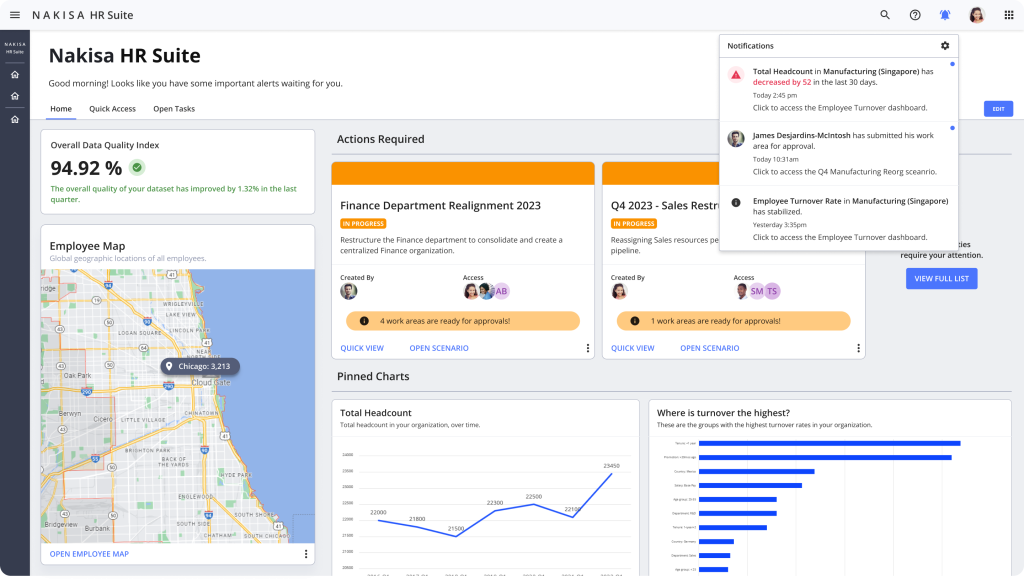

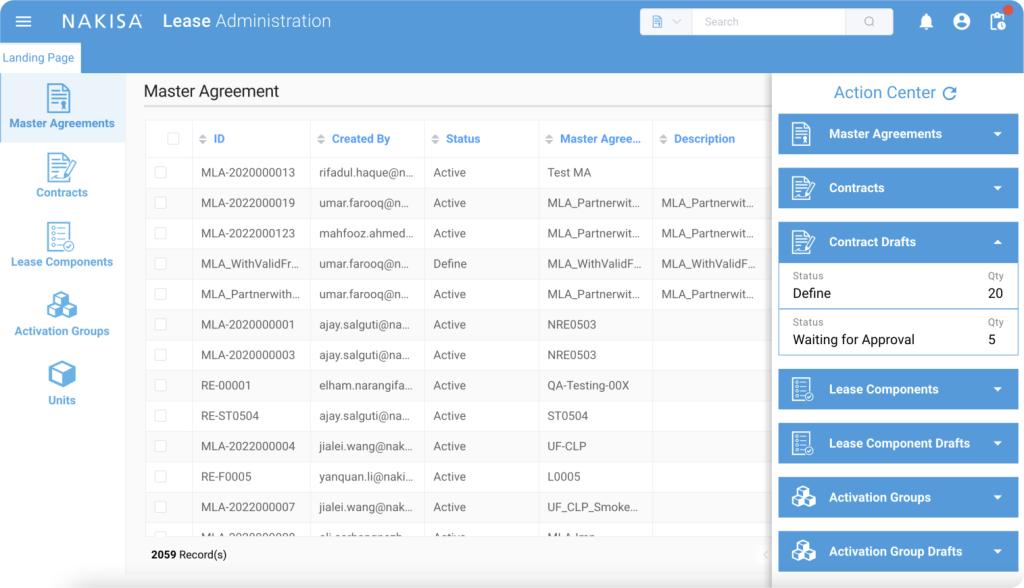

However, because of the complexity of the new standards, especially for larger organizations with a lot of leases, it may be time to consider a new approach. Comprehensive lease accounting software, such as Nakisa Lease Administration, helps to automate and streamline your accounting process. And, Lease Administration was designed to help accelerate compliance with standards like GASB 87.

Time is quickly running out to develop a strategy for complying with GASB 87. Is your organization prepared? If not, it’s time to think through what strategies and tools will help accelerate compliance and streamline your entire accounting approach.