Believe it or not, there’s a silver lining to the big changes to lease accounting under ASC 842 and IFRS 16. Just like climbing a high mountain gives you a perspective you can’t get from the valley floor, once you’ve completed the massive task of consolidating leases, capturing the information, and making the required calculations, you’ll gain a new perspective on the leasing operations of your organization.

Leverage your new-found knowledge for better deals

With all the information in one place and available for analysis, your organization can make better decisions about leases. Consolidating lease data will make it easier to compare lease terms – and negotiate better leases.

When you know what the embedded rate is, you’ll have leverage to negotiate a better deal next time. If the embedded rate is higher than the current rate at a bank, purchasing may be a better deal than leasing. In a few years, benchmark data for leases across different industries will likely be available, which will make it even easier to get better deals.

And there may be some welcome surprises as well – you may find long-forgotten leases for equipment you no longer need, so you’ll be able to shed those liabilities.

Leasing decisions will now involve more stakeholders than just procurement. Finance will also likely be involved because of the potential impact a lease can have on financial statements. While this may make deal-making more cumbersome, the additional input will help ensure that the deals will be in the best interest of the organization.

The Mount Everest of information gathering

However, even with all the benefits to consolidating lease data, the consolidation process itself will pose a big challenge for many organizations. Simply identifying all the leases will take effort as records can be scattered or incomplete. It may take detective work and close examination of payables and the general ledger to find all your leases.

Once a lease has been identified, then you have to track down the agreement. Some documents may be missing, illegible, or written in foreign languages. Information in the document may not be accurate if the agreement has been changed informally.

Leases in unlikely spots

You may discover that some of the informal arrangements your company has with vendors are really leases, so those arrangements will have to be formalized. Likewise, you may find that some arrangements labeled as leases actually aren’t leases under the standards. And there may be embedded leases in some service agreements, so you may have more leases than you thought.

The balance sheet isn’t the only thing that will change

With the major changes to the balance sheet, KPIs and financial metrics will change. Target ranges for KPIs may need to be revised. Stakeholders may need education so they’re not alarmed by the new balance sheet. Agreements that refer to the financials may need to be renegotiated – this can include executive compensation and debt covenants.

What will you do for the transition year?

Another big decision is the approach to take in your accounting policy. The modified retrospective is a bit easier because you don’t have to restate prior year financials. But this makes it harder for financial statement users to make comparisons between the years. Options that reduce the cost of implementation can make comparability harder, so you may need to discuss this with stakeholders.

Get started now, if you haven’t already

Compiling the information from your leases will take longer than you think. Some experts have estimated that processing each lease will take between 90 minutes and three hours. If you have lots of leases, you may need outside help to get the work done.

Where does technology fit in?

If you only have a few leases in your portfolio, you might still be able to handle the calculations for journal entries and disclosures with Excel, but it will be way more complicated than it used to be. You definitely won’t get the information you need straight out of your ERP.

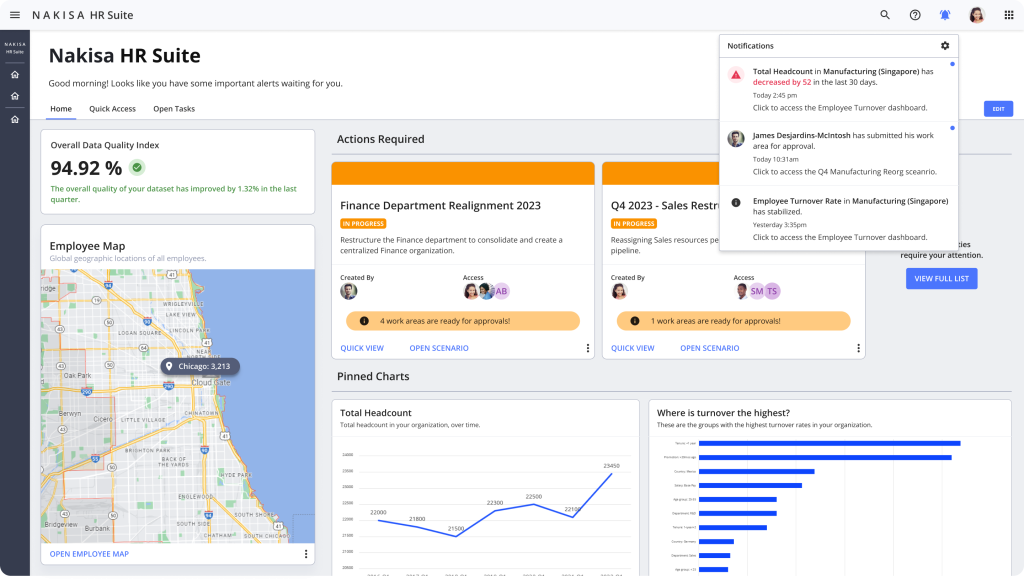

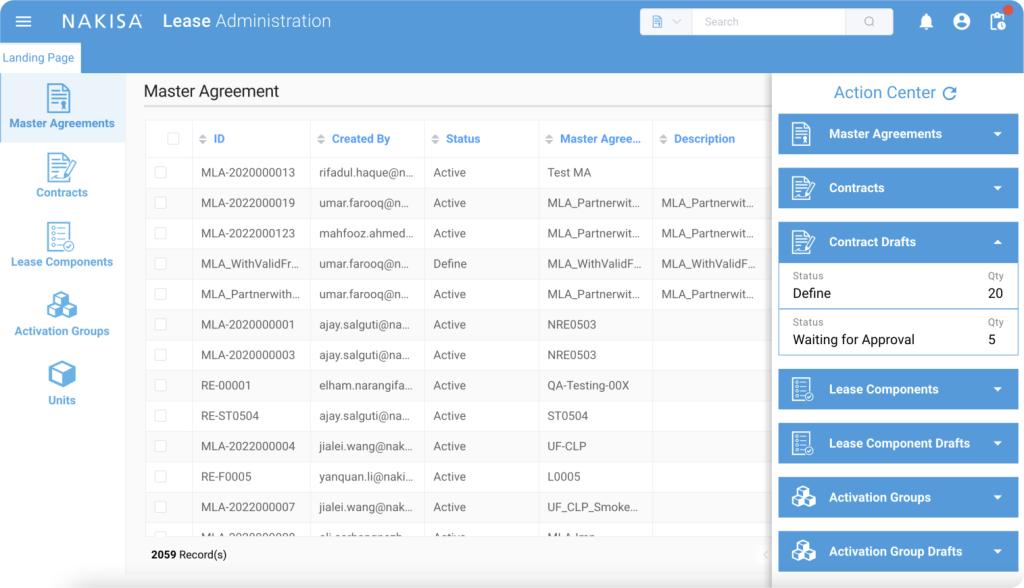

With a significant number of leases, dedicated lease management software is a must. These solutions automate and streamline administration and accounting, giving you more time to analyze the data and plan for the future. The best systems will streamline the entire lease process from inception through the entire lifecycle.

Technology can help tame the mountain of data for your leases. Here at Nakisa we’ve got you covered!