Who is concerned?

It’s been a busy couple of years for accountants preparing to report within the framework of the new IFRS 9, 15, and 16 standards, and their US GAAP equivalent ASC 326, 606, and 842. The last remaining standard to adopt is IFRS 16 (ASC 842) effective as of January 1, 2019. While early adoption is permitted for entities already applying IFRS 15 (ASC 606), few companies are compliant as of today. For organizations in the life sciences industry, adopting the new standard has proven to be no easy task. If your business operates in the fields of biotechnology, pharmaceuticals, or medical technology (to name a few), you have already undoubtedly tried to pinpoint what industry-specific challenges are likely to arise.

Everyone wants to be transition-ready in time, but unfortunately this can’t be achieved in a snap of a finger. Hopefully, you have already begun your transition to meet the mandatory effective date of January 1, 2019. This article will help you stay on track.

What does it involve?

IFRS 16/ASC 842 raison d’être

- The current method for reporting operating and finance leases results in a significant lack of transparency and comparability. IFRS 16 (ASC 842) was introduced to help mitigate these issues.

Right-of-use assets in the life sciences industry

- The life sciences sector often finds itself on the lessee side when entering into agreements. Many of these are accounted for as operating leases and will likely need to be brought over onto the balance sheet as of January 1st, 2019.

- In the life sciences industry, reporting in accordance with IFRS 16 (ASC 842) will affect many different types of leasing arrangements, such as physical assets from medical devices and laboratory facilities, to services such as contract manufacturing operations and research activities.

- Note that most life sciences companies will come across contracts covering the right-of-use for multiple goods and services (which may or may not contain lease components). Extensive collaboration between various external parties results in complex agreements that may include embedded leases. Sometimes, the agreement outlining acquisition of medical equipment or contracted research activities will present lease and non-lease components which will be accounted for separately. In such cases, the correct interpretation of the lease standard in determining how to account for a specific good or service will become paramount.

- Hospitals will often lease medical equipment directly from the manufacturers and will face complex accounting issues as part of the various terms and conditions of the lease. For example, consideration for a medical device may be entirely based on consumables that the hospital will purchase on an ongoing basis. The agreement may outline a required minimum consumables purchase or base the device payments on the amount of consumables ordered.

- Life sciences organizations often enter into multi-year contracts, which provide a great example of how embedded leases may impact your statements. Transaction costs incurred when signing the contract can be prorated over the lease term when relevant, and therefore will not hit the income statement all at once. Since expenses such as legal and accounting fees can quickly amount to a significant sum, the impact is noteworthy.

- Punctual events also have the potential to change the treatment of the right-of-use assets. As technology continues to evolve at a rapid pace, medical equipment may become obsolete or experience a decrease in value. Companies may feel the need to exit an agreement as SR&D strategy shifts and leased lab space becomes redundant. Both events will result in a re-evaluation of the right-of-use asset, and will impact its accounting treatment.

Implications for life sciences

- Life sciences organizations need appropriate systems and controls in place to classify and report properly on different lease contracts.

- Most life sciences leases and lease components, with exception for low value assets and short-term leases, will be presented on the face of the balance sheet, thus mostly eliminating the off-balance sheet financing through reporting in the notes and disclosures section. An asset and a liability will be recorded.

- Besides reporting and administration, life sciences organizations will face the implications of the new model when negotiating contracts, compiling KPIs, and analyzing systems and data requirements.

How to derive benefits while addressing the new standard?

Lease accounting under the new standards is becoming extremely complex, and the resulting changes may have a pervasive effect on financial statements. Organizations with large and disperse global lease portfolios will likely require lease accounting software to address compliance. Addressing IFRS 16 (ASC 842) early on will give the professionals involved the opportunity to scope the amount of work to be accomplished, which is often underestimated. One of the first steps to compliance is the collection of data. This involves collecting all contracts, determining if a lease exists, and clearly defining all terms and conditions.

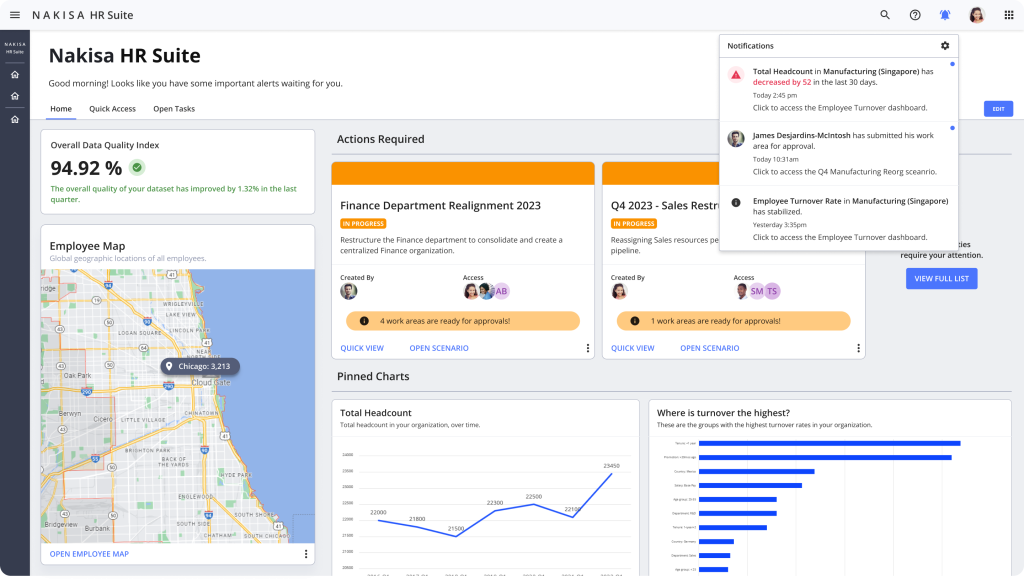

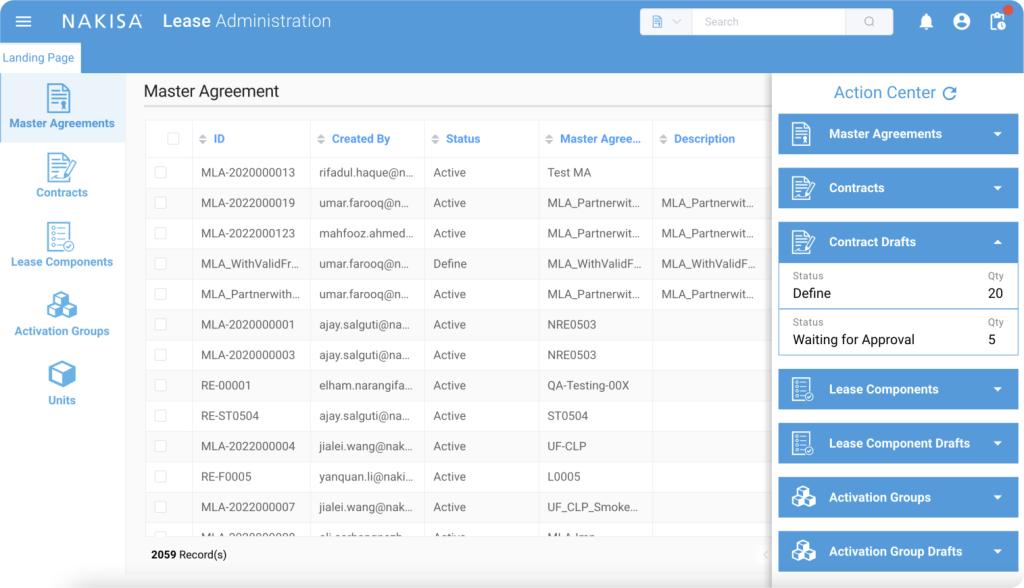

Data collection can quickly become an overwhelming task once you understand the scope. While today most leasing data resides in spreadsheets, a system will be required upon consolidation. At Nakisa, we offer a proven end-to-end lease management and accounting solution, implemented by numerous Fortune 1000 companies around the globe. Nakisa Lease Administration allows you to streamline lease accounting by automating and simplifying ongoing lease management. Compliance with reporting standards, automating monthly payments, centralizing data, and visualizing your global lease portfolio are just some of the benefits that are currently available to you through our software.

If you would like to see how technology can help in managing and reporting on your lease portfolio under IFRS 16/ASC 842, a 5-minute demo video is available for you to watch here. For further discussion, please contact Fergus Yeung at info@intranetorgchart.com.