Lease accounting is a lot like golf. Now that’s something you’ve probably never heard before.

While the ultimate goal in golf is to get your ball into the hole, there are many different approaches you can take based on distance, equipment and terrain.

The same idea is true for lease accounting.

The ultimate goal under the lease accounting guidelines IFRS 16 and ASC 842 is to properly document all leases on a balance sheet. How exactly that is done will be dictated by the type of lease you’re accounting for.

Real estate and equipment are two of the most common categories of long-term operating leases. Each category requires its own strategy of accounting for associated assets.

When it comes to understanding the basic differences between these two categories, the names say it all. Real estate leases cover property and buildings such as retail stores, manufacturing centers, and corporate offices. Equipment leases make up a much broader category that covers everything from office printers and equipment to corporate vehicles.

The differences between the two categories may seem obvious but understanding the difference in lease accounting for each is much more complicated.

While the full list is a long one, here are five important differences between real estate and equipment leases to keep in mind as you continue to refine your accounting strategy.

1. Dollar Values vs Lease Complexity

Due to the nature of the assets they encompass, equipment lease portfolios typically have smaller dollar values, but many more leases and assets associated with them than real estate leases. Think of all the pieces of equipment in your office—from your computers to your printers to your desks to your internet servers. It’s a long list. Still, your leased property and buildings are most likely worth much more than the equipment in them. A common mistake organizations make is to focus the majority of their lease accounting efforts on bigger value real estate leases. The compliance challenges of equipment leases are often more complicated.

2. Different Ownership Structures

In most large-scale organizations, real estate assets are managed by a centralized real estate group usually supervised by the CFO or another c-suite leader. This group manages all aspects of real estate purchasing, construction, and management. Equipment leases, on the other hand, often do not have centralized management structures. Ownership of each lease depends largely on the type of equipment—whether that’s IT technology, fleet shipping vehicles, or operations equipment. Because equipment leases are decentralized, data abstraction is more challenging and new processes must be defined for contracts post go-live.

3. Rent Payment Calculations

While base and variable rents are used in both real estate and equipment contracts, they are structured differently for each type of lease. Equipment lease base rents are usually calculated based on a percentage of the original cost of the equipment. Real estate base rents, on the other hand, are largely constructed by cost per unit—and are market-based. Variable rents for real estate leases are often adjusted based on market indicators such as the Consumer Price Index (CPI). Variable leases are rare for equipment leases.

4. Number of Assets per Schedule

Equipment leases often contain hundreds, even thousands of assets per single schedule. Think about a company that orders desks for its new corporate headquarters. It makes a lot more practical sense to bundle those under one inception entry than to maintain them individually. However, under the new lease accounting standards, each identified asset must be managed as its own lease. Real estate leases usually have only one large asset such as a building or tract of land. These leases do not have the complexity of equipment leases at the asset level.

5. End-of-lease Term Options

When their terms are up, both real estate and equipment lessees have three potential options—though they are different for each type of lease. Real estate lessees can choose to terminate the lease, giving up the rights to that property. Secondly, they may renew their current lease. Lastly, they can expand or reduce the amount of space or property on the lease. With equipment leases, lessees can terminate the lease and return that equipment. They can also renew the current lease. Or, they may elect to buy that equipment from the lessor. Often, all three of these options may be undertaken for different assets—making lease accounting for equipment very complicated.

6. Making it Simpler

Even this short list of differences between real estate and equipment leases gives us a glimpse into the complexity of lease accounting under the new standards. Equipment leases, in particular, offer a host of challenges that traditional real estate lease accounting solutions simply can’t effectively manage.

This is why a growing number of organizations are looking to more comprehensive lease accounting solutions.

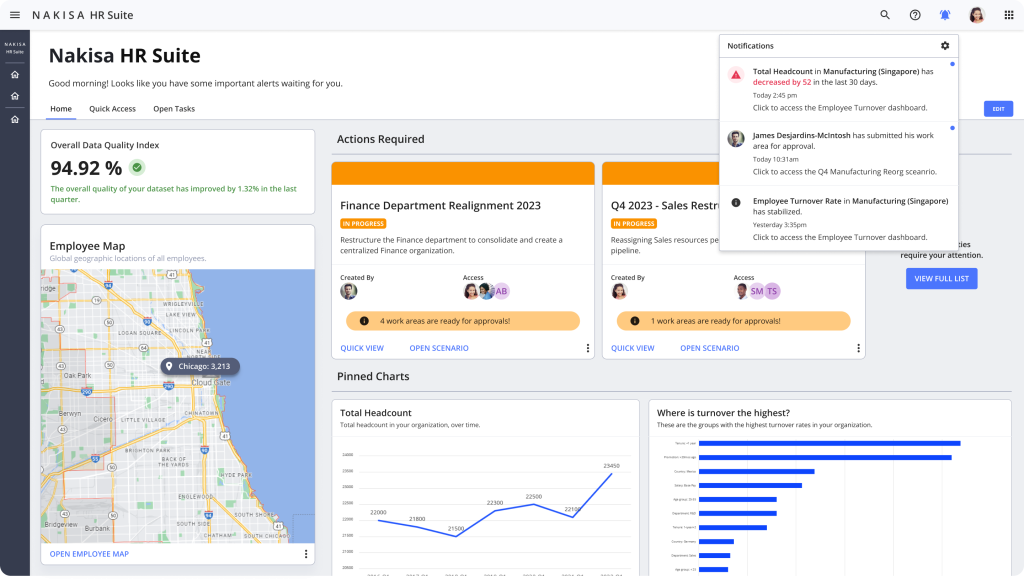

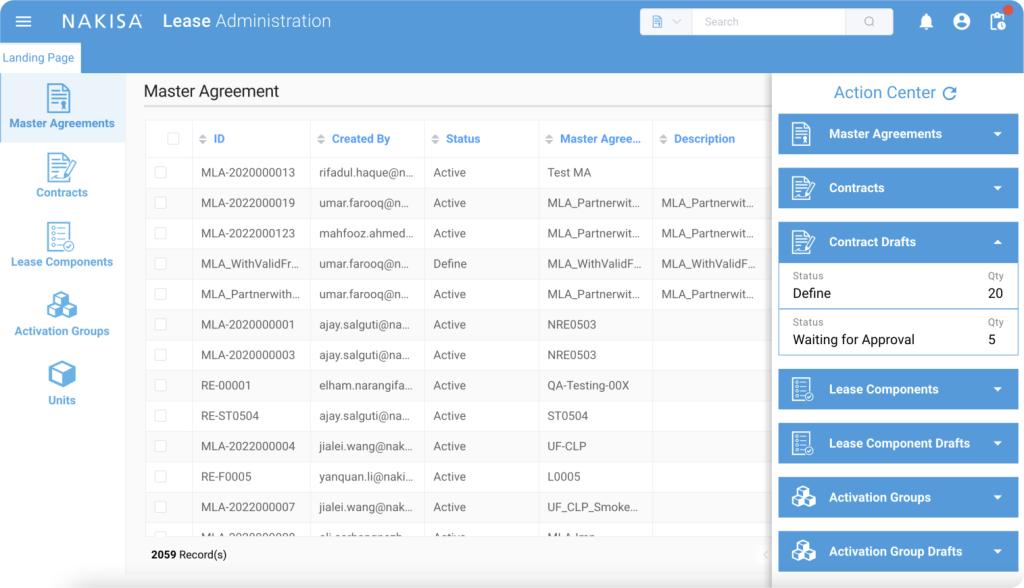

Nakisa Lease Administration offers management for both real estate and equipment leases, standardized lease determination and classification, and facilitation of modifications, remeasurements, and asset casualties.

Is your team equipped to effectively navigate the differences between the many leases you are managing? If not, it may be time to consider a new technology solution that can take the guesswork out of lease accounting and allow you to focus on the work that really matters.