Despite its quirks, we accept the traditional Gregorian calendar as the standard time marker in our daily lives. There is even a poem we learn as children to help us remember how many days are in each month.

Thirty days hath September,

April, June, and November.

When short February's done,

All the rest have 31.

In the business world, the calendar’s irregular nature often creates challenges for those who use data to appraise results and make decisions. The traditional calendar can be especially cumbersome for those businesses where variations in the total number of days or the number of specific days of the week within a period can skew trends. Those cases beg for a solution stronger than a poem.

The 4-4-5 Calendar Offers Several Benefits

With a 4-4-5 calendar, the standard 52-week year divides into four 13-week quarters, which comprise three periods split into a four-week, four-week, five-week format. A twist to this uniform structure occurs every five or six years when a fifty-third week is necessary to catch up for leap years and the fact that the standard 52-week year accounts for only 364 days.

Retailers are the most common users of the 4-4-5 calendar. However, firms in other industries see benefits from this approach to dividing a year into reporting periods. Typical cases include firms tied to the retail trade or for which labor forms a large share of the cost structure. These include consumer goods distributors, manufacturers, and service firms.

Forgiving the odd fifty-third week, year-over-year comparability is the most often cited advantage of the approach. That advantage stems from the fact that, under the 4-4-5 calendar, any period in one year has the same days-of-the-week composition as that time frame in a past year. For any field where certain days of the week are higher volume days, such as Saturday in the retail world, this consistency is a worthwhile factor in deciphering between calendar anomalies and substantive trends.

Companies who use the weeks-based calendar often do so when there is a natural alignment with core business flows. These flows include customer traffic, shipping, payroll processing, and procurement. These firms often find that period-end cutoff is less complex for those costs, and there is better matching of costs and revenues.

Those Benefits Come With a Few Challenges

While alignment with core business flows can be a benefit of using a 4-4-5 calendar, users often need to adapt systems and processes to address certain hurdles. The most common conflicts and questions involve how to allocate costs across periods of different lengths (i.e., a 4-week period vs. a 5-week period).

For instance, consider leases, utilities, and twice-monthly payrolls, which are services with regular monthly billing cycles. Charging these costs as they are billed may lead to a 5-week period having two rent charges, two utility bills, or three payrolls. This approach overloads the 5-week period with costs, distorting the margins earned on sales in those times. On the other hand, smoothing these costs evenly in each period causes a 5-week period to have higher margins than one with 4-weeks. The same issue exists for dividing lump sums across several periods, such as depreciating fixed assets and amortizing prepaid expenses.

Except for a guiding principle that a business should allocate costs in a systematic and rational manner, there are no set accounting rules for these issues. Each company has room to choose their accounting policy based on the amounts involved. In practice, a common method of addressing the issue is to allocate costs based on the number of days in the period.

Choose Business Tools that Work for You

Companies choose alternative calendars when doing so serves their data needs and aligns with their systems and processes. These companies have identified proven means to adjust for the challenges so that overall, the calendar works for them and fits their needs.

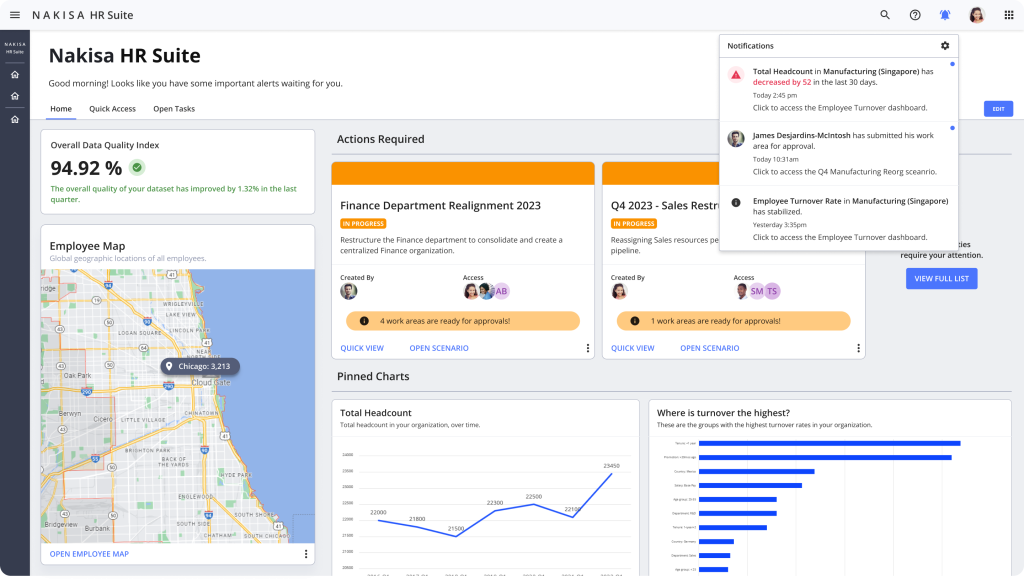

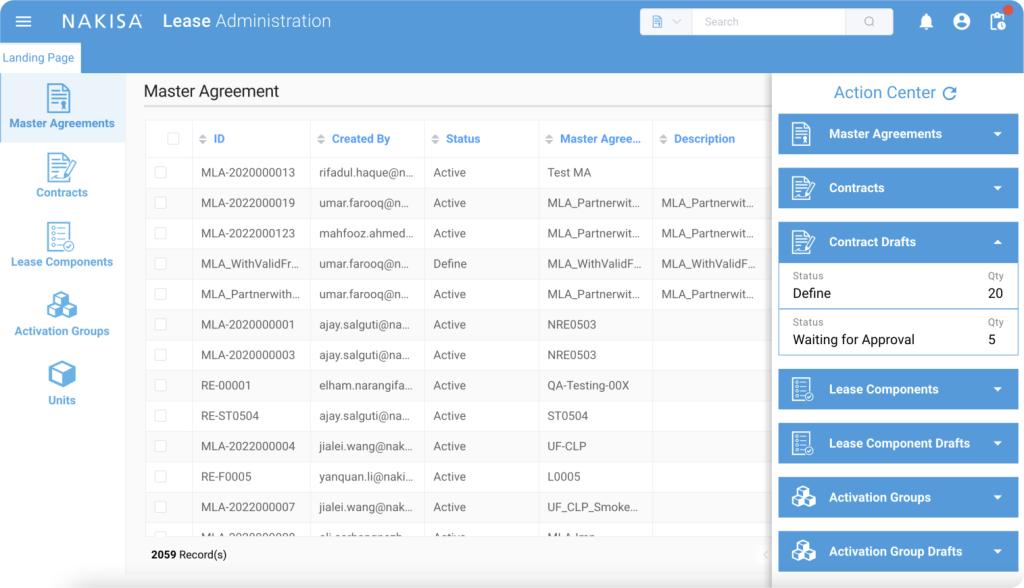

Ensuring a fit with your needs is a key part of the due diligence process for any new business application. This holds whether the new tool automates routine processes like bank reconciliations or streamlines a global lease portfolio. Sometimes, conforming your workflows to fit a new tool can yield productivity gains. In other cases, you want to make sure that the new application can work with your current setup. Whether it’s the flexibility to adapt to your unique calendar, or the ability to leverage existing ERP data and technologies, you want to choose tools that work for you, not the other way around.