The global impact of the coronavirus pandemic brought our record 11-year bull market to a close in February 2020. Never before has a bear market been ushered in so swiftly. Bloomberg reported that the 2020 stock market drop was the fastest 20 percent decline of the past 120 years—including the Great Depression, which began in 1929 and lasted until the start of World War II, 10 years later.

One of the greatest business challenges at this time is that none of us know how long the effects of the coronavirus will last. A recent article in Smithsonian magazine states, “In many ways, the COVID-19 pandemic has proven to be a moving target. Faced with stopping a pandemic that scientists have yet to fully understand, researchers simply can’t guarantee what lies ahead—or when life will return to a version of normalcy.”

Certain potential long-term economic effects of the pandemic should be considered when planning for the future. With such an unforeseen, dramatic, and rapid stock market drop, many industries will have to react quickly, given that we may be in the early stages of a recession.

Affected industries will be looking to:

- Seek government bailouts.

- Explore options to leverage technology for flexibility and efficiency. (Working from home has pushed many organizations to institute remote work policies, and as such, a number of technology companies have reaped benefits. For instance, according to Markets Insider, stock prices for Zoom, the video conferencing software, more than doubled from mid-February to late March 2020.)

- Look for ways to save money and cut spending.

Although COVID-19 has caused widespread economic disruption, its impact has been experienced differently across various industries. The following is a deep-dive analysis of three highly impacted industries, and an investigation into the areas that have been most affected.

Retail

Social distance protocols and lockdowns have contributed to making retail one of the industries most disrupted by the pandemic, particularly from a visibility standpoint. Although food service retailers such as Costco and Walmart are faring well, fashion retailers have been hit hard. With a combination of contributing factors including manufacturing stoppages, a lagging supply chain, and shuttered store fronts, this is not surprising. The effects of the pandemic on the retail industry aren’t just touching brick-and-mortar shops, but also the industry as a whole. According to a recent article in Marketplace.org, about 40 percent of the clothes worn by Americans are imported from China, meaning that even online retailers are likely to be impacted.

With regards to actionable responses from a lease accounting perspective, mass closures, impairment, and abandonment of property and equipment will occur at a rapid pace. What is unique about this situation is that impairment, abandonment, and other highly time-sensitive modifications of right-of-use assets are likely to take place in mass.

Oil and Gas

The oil industry was already contracting before the coronavirus outbreak. Tensions between Russia and Saudi Arabia, coupled with overproduction, triggered a sell-off in crude oil and a drop in oil prices. This combination of pre-existing circumstances, in addition to the widespread effects of the COVID-19 pandemic, have together resulted in an unparalleled decrease in the demand and price for oil.

To compare prices, on January 2, 2020, the WTI price of a barrel of oil was $60.24. By March 23, 2020, it was $23. What is worth noting is that it costs more to produce a barrel of oil than its March 2020 market price.

The impact of the pandemic on the energy sector is already affecting individual companies. Bloomberg Canada reports, “Husky Energy is suspending projects as it navigates a troubled oil market with a debt load of more than $5 billion.”

The health of the gas and oil sector is important to track, as the industry impacts the economy as a whole, given the fact that crude oil is essential for production in many, if not all other industries. Given that the drill-rate has been decreasing, the situation will also trigger impairment for oil and gas equipment, further emphasizing the need to be prepared and take control.

Airlines

Due to the pandemic’s widespread travel bans, the airline industry is probably the industry impacted the quickest and hardest. What is unfortunate is the fact that many airlines had a great start to 2020, hitting all-time highs in capital markets.

According Yahoo Finance, Air Canada hit its peak stock price of $52.71 in January 2020. However, because of COVID-19, by April 6, 2020, the stock was trading at $15.16. Likewise, Delta Air Lines CEO Ed Bastian communicated, in a memo to employees, “the airline was burning through more than $60 million in cash every day,” adding that the organization had canceled about 115,000 flights for April, or 80 percent of its total schedule.

Even when considering a post-COVID-19 return to normalcy, there may be lingering impact on airlines as people may not feel as comfortable about traveling immediately after the crisis. Airlines will not only have to be competitive, but work on making meaningful changes and commitments to consumers in order to keep them informed of the processes they will have adopted to ensure the safety of their operations.

Market Reaction

There is a light at the end of the tunnel for these industries. Governments have stepped in to provide relief packages for airlines—the United States recently allocated $58 billion of its $2 trillion stimulus package to airlines. Moreover, according to the CNBC, U.S. airlines and the Department of Transportation are considering consolidating dozens of services to help save costs.

With regards to the oil industry, as of April 2020, communication between Saudi Arabia and Russia (alongside other government interventions) seem to reveal dissipating tensions, which may help stabilize the price of oil.

What is both unprecedented and positive is the fact that this may be the first time in history where the main focus of the global economy is to work together to get through this pandemic, as seen in the example from the airline industry. As well, industries like GM, Tesla, and Xerox have pivoted from their main areas of production and are now making ventilators. Amazon is attempting to ban the sale of n95 masks to the pubic and dedicate them to the medical field. These are all testaments to us as a society and we should be proud. However, what is important from economic perspective that we and develop methods to optimize processes and explore areas where technology can be leveraged to reduce costs in order to regain control of their business during the pandemic, and not once it has passed.

Nakisa’s Response

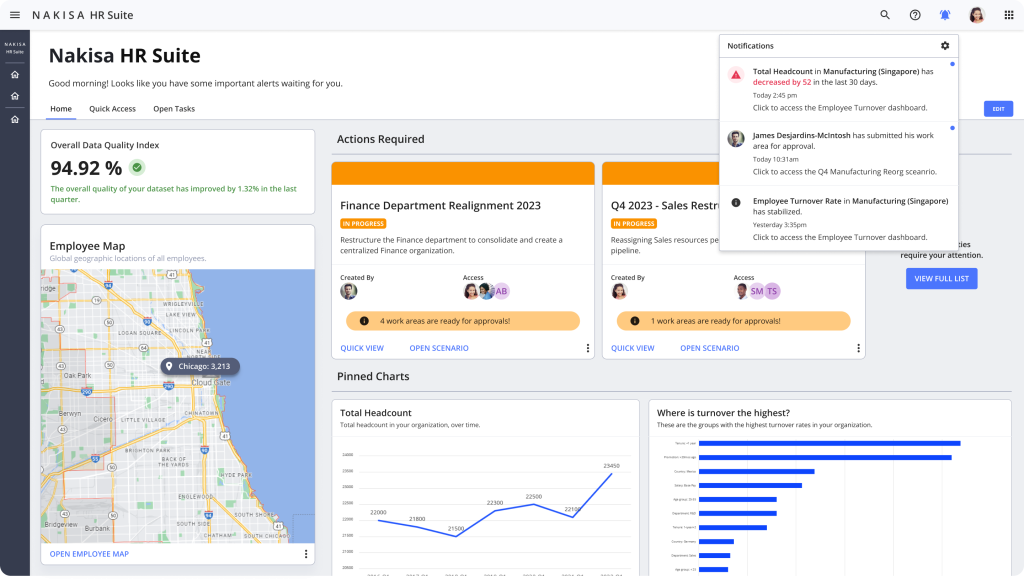

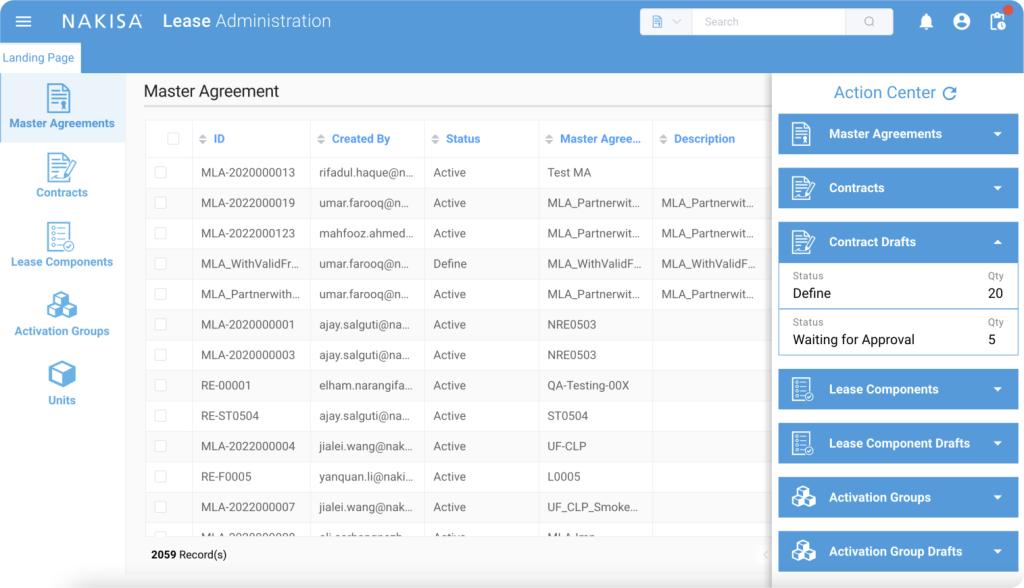

Nakisa Lease Administration is a dynamic and scalable solution, able to perform these critical mass modifications accurately. In the current climate, impairment and accelerated depreciation for abandoned assets will be taking place in mass volume, which is paramount, as compliance is not optional. Nakisa Lease Administration has the unique capabilities to perform these functions, both equally critical and time-sensitive for the three industries mentioned in our current climate.

In addition, budgets, financial modeling, targets, rolling forecasts, and scenario-testing are going to have to be quickly and perpetually amended, especially due to the uncertainty of air travel and the length of store closures. Nakisa Lease Administration offers a Financial Planning and Analysis Dashboard, with real time data with respect to cash-flow per lease, currency, and asset class. The Nakisa solution can serve as a competitive advantage to actively forecast and update targets to be disclosed to investors, which is key.

Nakisa is invested in helping all industries remain resilient in these challenging times. In a subsequent blog, we will deep-dive into more industries affected by COVID-19.