Long-term players in the oil and gas sector have experienced many downturns. Severe price drops hit the industry in 2008 and again in 2014. Price levels may have a more or less painful impact relative to current factors, such as the breakeven point for reserves, production costs, debt levels, communicated share buyback, and dividend policies, among others. What is different now in the first half of 2020 with the latest price drop arising from both supply and demand issues? Indeed, an article published by PwC titled “COVID-19: What it Means for the Energy Industry” states, “Disruption in the sector may lead to numerous financial disclosure implications, and companies may need to make the necessary assessments across their business—from the value of assets to liquidity and other risk disclosures.”

For the set of companies that are now live on ASC 842, one key difference to these disclosures is potential impairment of ROU assets for operating leases. Under ASC 840, this population of equipment and real estate remained outside of ASC 360 considerations. Now, looking at upstream as an example, leased drill rigs that are part of in-use asset groups subject to impairment will require a different accounting treatment. What was formerly a relatively straightforward expense exercise with these assets now requires decoupling the amortization of the ROU asset from the related lease liability and amortizing the asset on a straight-line basis. This, while the liability remains classified as an operating lease, and therefore subject to its existing effective interest method.

“Disruption in the sector may lead to numerous financial disclosure implications, and companies may need to make the necessary assessments across their business—from the value of assets to liquidity and other risk disclosures.”

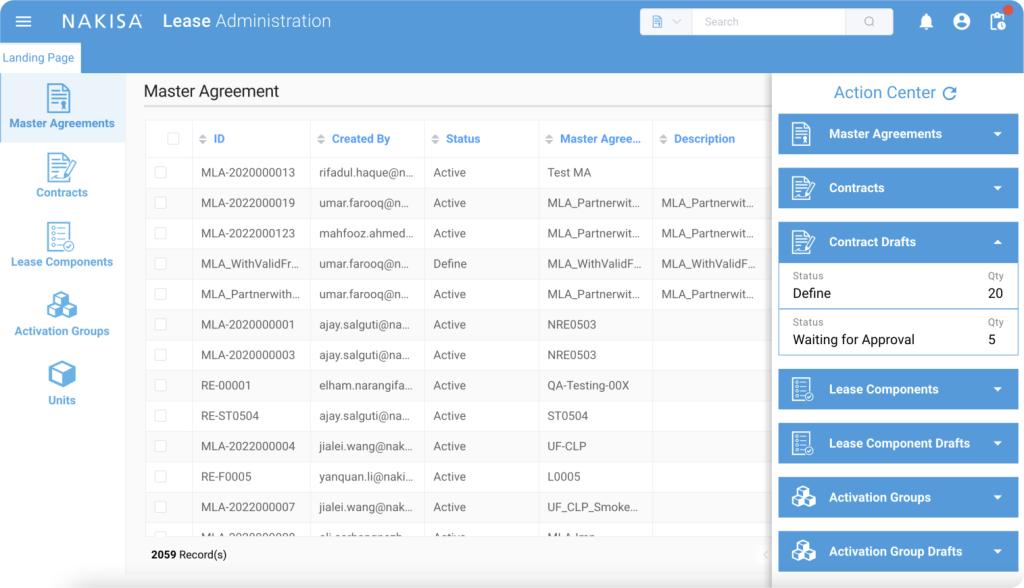

Day 2 accounting under ASC 842 is an ongoing task. The bifurcation of the treatment of operating ROU assets and lease liabilities adds an additional continuing effect after following the two-step impairment model under US GAAP. Operationalizing the accounting, reporting, and disclosure impacts is desirable in a manner that preserves auditability and can be achieved efficiently. When cost control measures are being enacted, processes that require additional finance and accounting effort, as well as additional headcount, are counterproductive.

Adopting Business Resilience in a Challenging Economy for Lessees

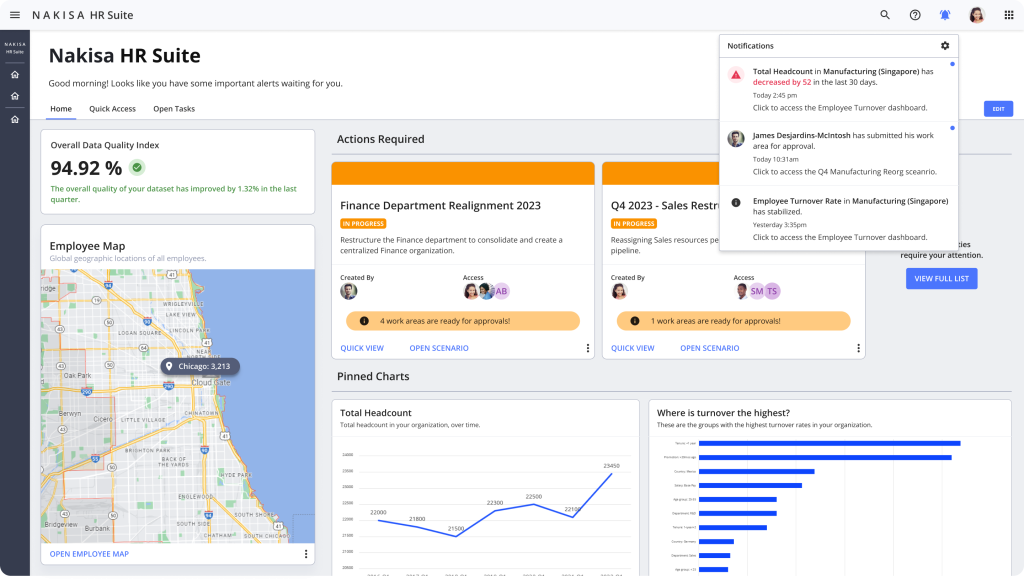

From a forward-driving perspective, there has never been a more pertinent time to leverage lease accounting software. The automated research and reporting tools of a lease accounting software solution allow users to analyze costs versus benefits for informed decision-making. Built-in impairment functionality and the ability to make mass changes within the lease portfolio are essential for lease accounting sustainability.

Impairment and Abandoned Assets

- Under ASC 842, and with a potential recovery from the current price drop many quarters out, leased assets could be affected in upstream, midstream, and downstream segments.

- Companies will likely immediately trigger impairment of assets of which the economic value may be significantly reduced by negative market conditions.

- A critical feature of the current climate is that mass impairment and abandonment is likely to occur, which is quite significant, unusual, and new.

- Appropriately accelerate depreciation for abandoned assets is going to be a new reality, and it will be a requirement to have the technology to perform these modifications.

For more information, please email us directly at info@intranetorgchart.com.