This blog was co-authored by Bramasol.

| How to adopt IFRS 16 leases? | ||

|---|---|---|

| Full retrospective approach | Modified retrospective approach | |

| Current Period (2019) | IFRS 16 | IFRS 16 |

| Prior Period (2018) | IFRS 16 | IAS 17 |

| Date of equity adjustment | 1 January 2018 | 1 January 2019 |

| Costs | $$$$ | $$ |

| Comparability | ✔✔✔✔ | x |

IASB’s new standard on lease accounting – i.e. IFRS 16 – will become applicable for all reporting periods starting on or after 01 January 2019.

The main objective of the standard is to eliminate off-balance sheet financing. As such, the treatment of all leases will be brought under one umbrella and recognized on a company’s balance sheet, similar to how finance leases are currently treated under IAS 17.

It is important to remember that the application is relevant to lessees only, and as with most accounting standards, there are a number of exceptions. This includes leases with terms of less than 12 months or low-value leases. Payment on these leases can be expensed in a company’s P&L.

For all other leases, the biggest challenge for companies is choosing the right adoption method: retrospective or modified retrospective. The choice of adoption method approach must be applied to the entire lease portfolio. Additionally, lessees and lessors are not required to reassess whether an existing contract contains a lease upon transition. i.e. If a contract is classified as a non-lease under IAS 17 then an entity does not have to reassess the contract in accordance with IFRS 16.

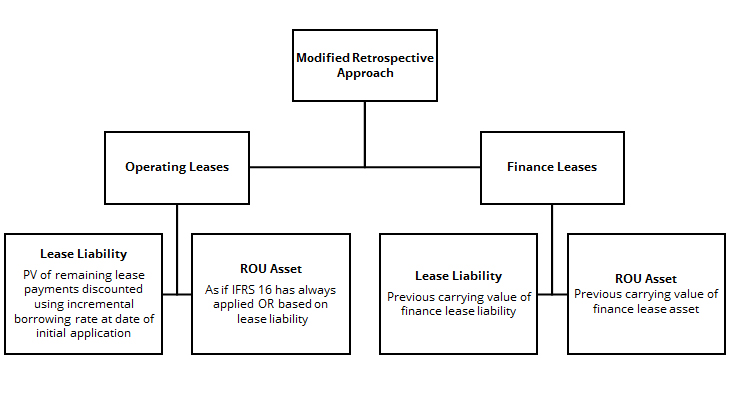

Modified retrospective approach

Under the modified retrospective approach, a lessee will not have to recast comparative financial information. Therefore, the date of initial application is the first day of the annual reporting period in which a lessee first applies the requirements of the new lease standard. At the date of the initial application of the new lease standard, lessees will recognize the cumulative effect of the initial application as an adjustment to the opening balance of retained earnings as of 1st January 2019. Prior periods are, quite simply, left as is under the recognition requirements of IAS 17.

The initial recognition involves calculating the present value of all remaining lease payments using the lessee’s incremental borrowing rate at the date of initial application and stating the lease liability at the calculated amount on the balance sheet.

There are two options for measuring the right-of-use asset on transition. It is important to note that this is done on a lease-by-lease basis:

- i) The first approach is to measure the asset as if IFRS 16 had been applied since the commencement date of a lease using a discount rate based on the lessee’s incremental borrowing rate at the date of initial application.

- ii) The second approach is to measure the asset at an amount equal to the lease liability, adjusted by the amount of any prepaid or accrued lease payments recognized immediately before the date of initial application.

The below summary simplifies the approach:

This approach can be a more cost-effective and less time-intensive approach but may compromise on the accuracy afforded by the full retrospective method.

Main advantages:

- i) Cost savings and time savings.

- ii) No need to restate prior year comparatives.

Disadvantages:

- i) Difficult to conduct performance ratios due to skewed comparatives of the old standard vs. the new one.

Full retrospective approach

A full retrospective approach requires companies to follow the scope of IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors, and present financial statements, as if IFRS 16 has always been applied. Under the full retrospective approach, companies will need to adjust opening retained earnings at the beginning of the earliest comparative period presented. This may involve a significant amount of work at potentially higher costs, as lessees have to go back to the commencement date of every lease contract it is currently committed to and gather the necessary information.

The adjustment has to be made to the prior year’s opening balance of retained earnings and all comparative financial information will have to be restated.

So, what will this look like in practice?

When you adopt IFRS 16 using the full retrospective approach for the financial period beginning on 01 January 2019, the adjustment to retained earnings will be made on 01 January 2018. It also means that, although you will present leases under IAS 17 for the 2018 financial year, in 2019 you will have to restate these same figures to comply with IFRS 16. Therefore, companies will apply IAS 17 in preparing its financial statements for 2018. They will then apply IFRS 16 to prepare comparative financial information to be included in its 2019 IFRS financial statements.

Main advantages:

- i) No estimations required, so financial figures are represented more accurately.

- ii) Accuracy of financial figures leads to higher quality reporting for audit and management purposes.

Disadvantages:

- i) Requires a lot more work because historic lease data will have to be collected and financial comparatives will have to be restated. ii) As such, the process will require more resources, more reporting, more disclosures, and will ultimately be more expensive than the modified retrospective approach.

Where does this leave you?

There is no right answer here, only what is right for your company. The choices you have to make on transitioning to IFRS 16 will always be a trade-off between comparative visibility and cost and time savings.

If you choose a full retrospective transition approach, your financial statements will be fully comparable and performance conclusions will be able to be drawn. But, it will involve much more work and therefore come at a higher cost, especially for companies that have large lease portfolios.

The indication is that most companies will go for the modified retrospective approach, purely from a cost and time-savings standpoint. That said, the disadvantages to this approach include a lack of comparability, which makes it difficult to evaluate the performance of an entity over time.

What is clear though, is that planning in advance is of the utmost importance as the decision might not be as straightforward for every company.