In 2016, the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) issued new requirement standards for lease accounting: IFRS 16 & ASC 842, which must be implemented by 2019.

With many questions surrounding the new standards, such as “what is categorized as a lease?” and “what can be reported and where?”, many businesses are taking advantage of intelligent cloud software that can help achieve compliance. However, the effective dates for the standards are looming and it’s crucial that all companies reporting under IFRS 16 and/or ASC 842 that want to implement accounting compliance technology have projects underway, or a plan to get started as soon as possible.

How cloud technology can help

Some financial analysts argue that IFRS 16 and ASC 842 are the biggest changes to ever hit the accounting industry. If this is the case, then it could be argued that cloud technologies are bringing the biggest benefit to lease accounting since the dotcom days. The shift has the potential to disrupt multiple aspects of your operations, and also provides an opportunity to identify areas for improvement, implement best practices, and streamline operations.

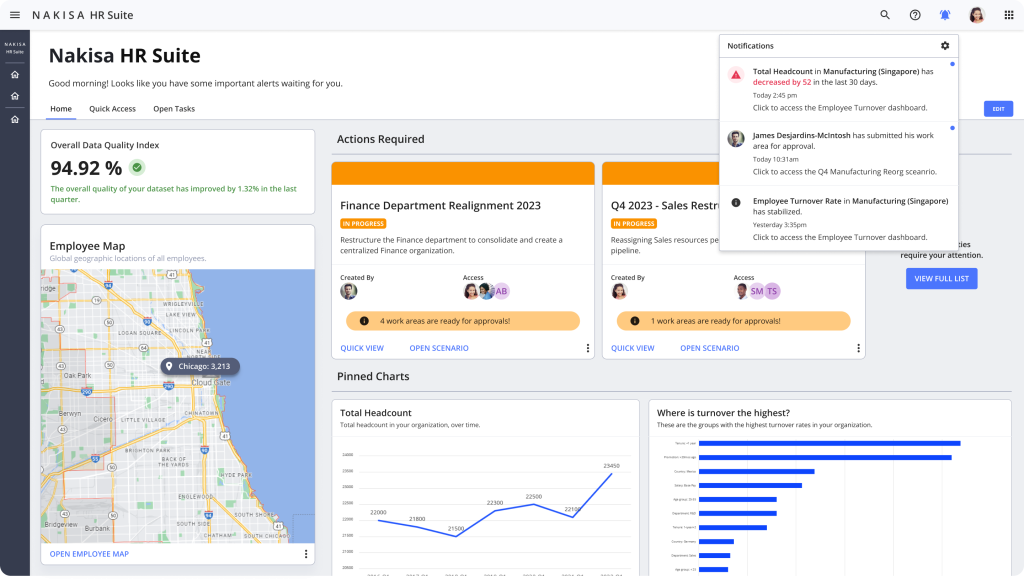

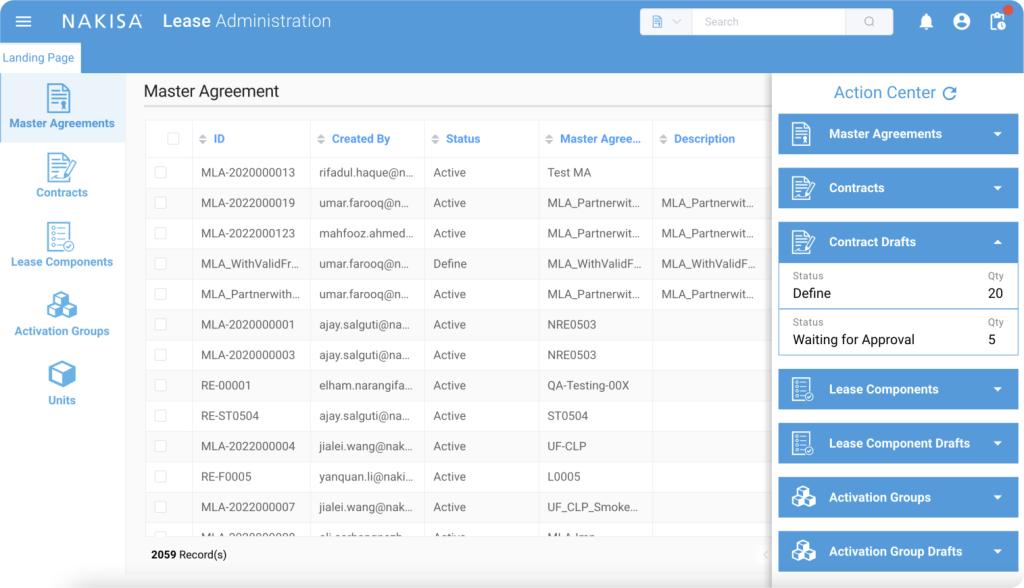

Not only can cloud lease accounting software support compliance initiatives, but it can do so in a relatively easy manner with minimal effort. Lease accounting processes are streamlined by automating, centralizing, and simplifying lease accounting operations. Typical cloud lease accounting software can access lease data residing in your core finance system, compile commonly needed reports and notify you of potential risks. This takes the time-consuming administrative work out of lease accounting and allows your finance team to assess your company’s lease portfolio and highlight potential areas for improvement or cost savings.

There are a number of other business benefits to consider when evaluating cloud lease accounting solutions. Cloud solutions significantly decrease the amount of time required to go-live by eliminating the need to discuss hardware requirements and software capability. Global leasing teams are able to access up-to date information at any time. Leveraging a cloud platform that consolidates your global lease portfolio and centralizes lease accounting processes allows you to simplify lease management, transition to the new standards, process required accounting lookback, and fulfill reporting requirements.

Why spreadsheets are not the answer

For those of you thinking that spreadsheets will be sufficient in supporting your compliance initiatives, it would be prudent to consider the following:

Spreadsheets are prone to accidental misuse and operator error, even by the most experienced users. You can also run into the pesky versioning issue, where inevitably, multiple versions of the same document start floating around and information quickly becomes duplicated or lost in email abyss. This could easily make the difference in your organization being compliant-ready or not. Moreover, you will be missing out on the fiscal and operational benefits of using cloud software for lease administration and accounting.

Spreadsheet-related issues become far more likely and even more complex if you have a decentralized process with various points of responsibility for your lease portfolio, such as finance operations split up in different geographical regions. The lack of centralization makes gathering your lease data into one, single repository a daunting task, and as a result, makes compliance untenable. Early-adopters are well advanced in their lease compliance projects and cloud-based lease accounting solutions have helped them to achieve this.